It is stunning how many people talk about money yet have no clue about monetary history. They do not even understand the most basic concepts about money, banking, and The Fed.

One area where there is a lot of confusion is with central bank reserves. This is evident by the statement "the printing press go brr". Anyone who says this obviously has no clue about how the system operates.

Being within the realm of cryptocurrency, if we are going to replace the existing financial system, it is best to understand how it actually works.

For this reason we will start with the most basic of concepts.

https://www.investopedia.com/thmb/momcCOOxxsSkZf1HbuM-Kq5d1Rg=/1500x1002/filters:fill(auto,1)/GettyImages-699686820-a630c3fcc96441e1ab8a0d2441731efb.jpg

The Fed Doesn't Print Money

Have you heard the story about JP Morgan (the man not the bank) saving the United States economy by bailing out the US government?

That is partially true.

In 1907, when panic struck the banking system. JP Morgan and other bankers got together to put up $25 million, a huge sum at the time, to back stop the banking system. But that was only one piece of the puzzle.

The U.S Treasury came up with $36 million that was deposited in New York City banks. This outpaces what Morgan and his investors came up with.

Again, this is only a part of the story.

The other piece is the clearing house associations spread throughout the country. They came up with $256 million. But this was not cash or even gold. Instead, they put forth clearing house loan certificates. These are inter-bank quasi money that allows banks to clear liabilities with other institutions within the system.

Essentially it is inter-bank credit and a vault substitute.

Notice how this is not cash, dollars, or specie of any kind. It is basically a bank token that was created by the clearinghouses.

We also have to mention this is before the creation of the Federal Reserve. Hence, when that was being developed, what do you think they did? The idea of being able to create an inter-bank credit to allow for the clearing of liabilities made sense. Therefore, it was incorporated.

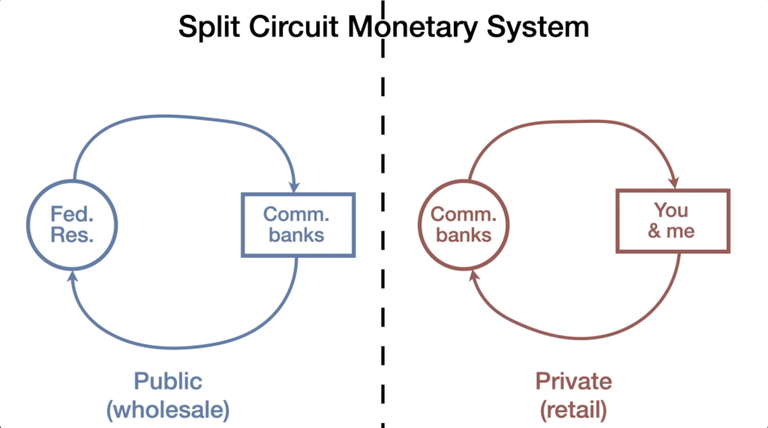

Of course, nobody would mistake a clearing house loan certificate for US dollars. Why do they do it with central bank reserves?

Here is where the Fed's propaganda enters.

Cashless System Post-World War II

We hear a lot about the "war on cash".

The reality is the banking system got rid of cash a long time ago. Since the 1940s, settlements among the banks were done using a ledger based system, something akin to checks. Nobody was sending bags of money back and forth.

There is also another factor in this that is very revealing.

For decades, bank reserves with the central bank were non-existent. The Fed believed it could control things by making the reserve more (or less) expensive. Unfortunately for it, having a currency meant to replace cash when the banking system basically got rid of cash is useless. This is what the Fed found out.

Also, we hear a lot about reserve requirements. However, the banks get around whatever the Fed says be either turning to different products, such as non-bank money market fund which isnt subject to reserve requirements or simply enter the Eurodollar market to get a better rate than the Fed is offering.

Once again, it becomes very clear. The Fed doesn't print money. In fact, the only tool in its bag is to target the fed funds rate. That is the only move it truly has. It can change that and hope things work out.

Do you see why I repeatedly say the Fed is mostly a propaganda organization?

The reality is, when it comes to liquidity, the commercial banking system is in full control of that and the Fed wasn't invited. This is why we see a dollar shortage in spite of trillions in central bank reserves being printed.

These are not dollars. Reserves are not legal tender and cannot be held by private non-bank businesses or individuals. Remember, like a clearing house loan certificate, a reserve is nothing more than inter-bank credit. How can anyone consider that to be broad economy money?

The answer is that, if one knows how things operate, it is an impossible conclusion.

Posted Using InLeo Alpha