Here is a link to the article mentioned in the video:

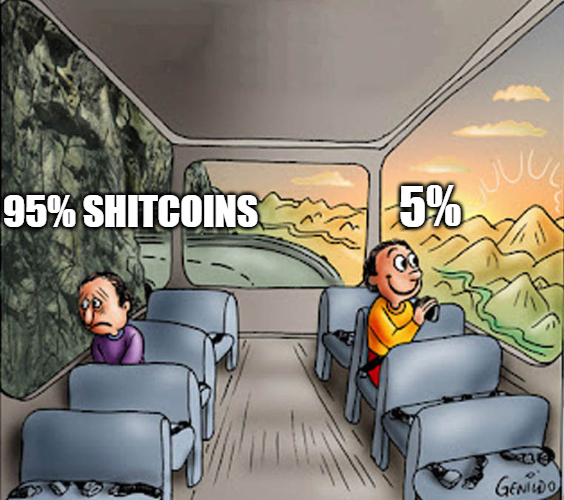

In this video I discuss how one of the founders of Internet Computer calls most blockchains junk. It is taking a look at things from a technical angle.

I opt for a differenet viewpoint, not trying to debate the technical side of things. Instead, we look at the essence of where Web3 is succeeding as compared to where it is falling short.

▶️ 3Speak