As expected, the FED remains at the center of global markets, as its decisions impact investment strategies, asset prices, and, of course, the broader economic climate. With uncertainty surrounding future rate cuts and persistent inflation, investors are wondering what the right market strategy should be.

INTEREST RATES

As expected, the FED kept its key interest rate at 4.25%-4.50%. This had already been priced in by the markets, which is why the reaction was relatively mild.

However, the focus is not just on today’s decision but on the FED’s outlook for the future. And this is where things get more complicated…

According to statements from FED Chair Jerome Powell, the economy remains resilient, but persistent inflation poses a significant challenge. So, while the markets may have priced in some rate cuts, the FED does not seem ready to proceed aggressively in this direction.

FORECASTS

The FED has maintained its forecast for two 25-basis-point rate cuts in 2024.

However, there have been significant shifts in the stance of its members, as we now see a more hawkish dot plot, with four committee members not expecting any rate cuts this year, compared to just one in December.

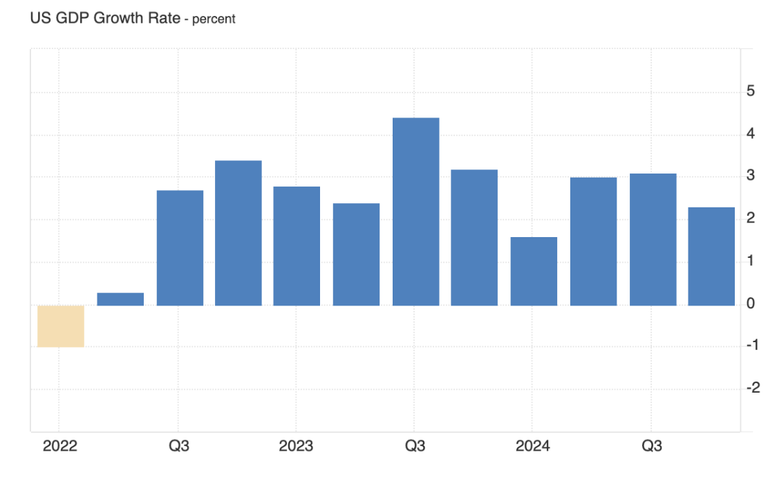

Additionally, there were notable changes in economic projections, with GDP growth for 2025 now estimated at 1.7% (down from 2.1%), signaling a slowdown.

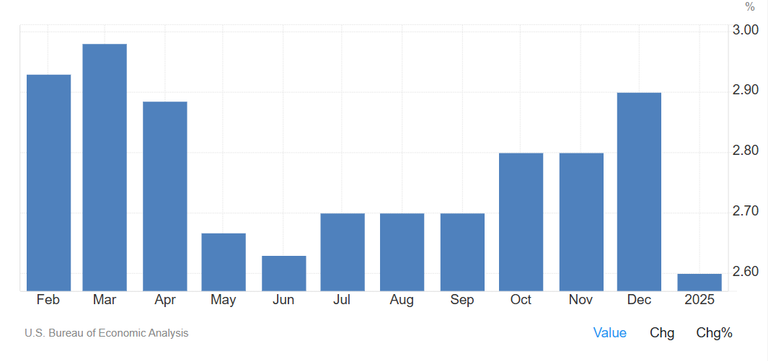

Moreover, Core PCE inflation was revised to 2.7% (from 2.5%), indicating that inflation remains persistent—enough of a reason on its own to hold off on rate cuts.

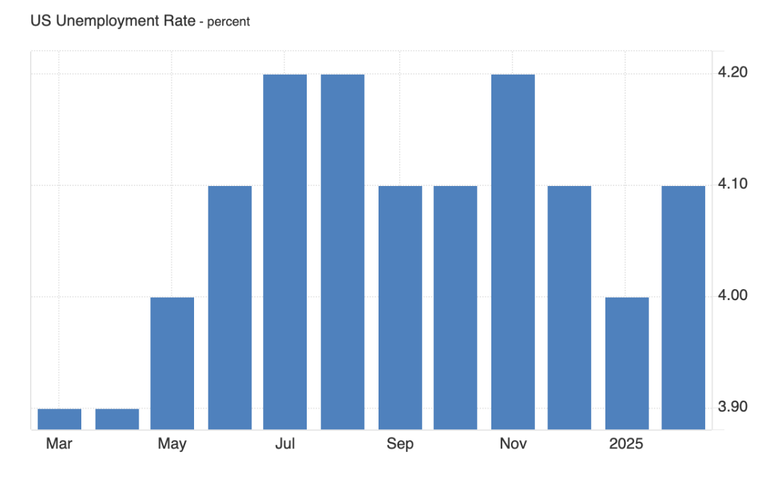

Finally, unemployment was slightly higher, with the 2025 estimate rising to 4.4% (from 4.3%).

In short, the FED acknowledges that the economy is slowing down but is also concerned that inflation may remain high for longer than anticipated. While strong consumer sentiment and a resilient labor market keep the economy on solid ground, price pressures still prevent a more aggressive monetary easing policy.

Posted Using INLEO