With all the chaos surrounding tariffs in recent days, we've kind of forgotten to look at the basics. So today’s a good opportunity to take a look at the latest economic news. Because yes, tariffs and geopolitics are grabbing all the attention—and not without reason. They affect markets, logistics, trade, and ultimately the prices we all pay every day.

But it’s the big economic indicators… that actually shape long-term trends.

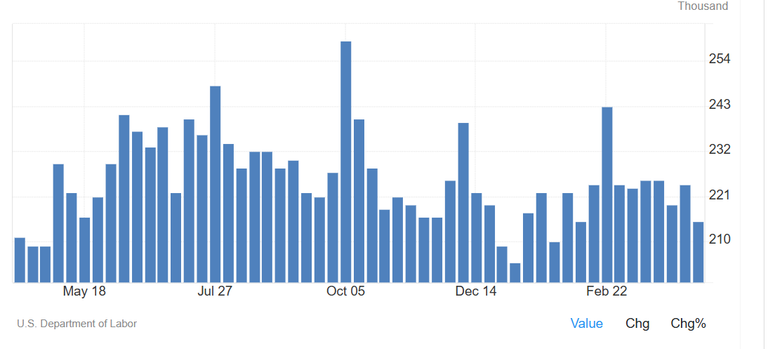

And this week, we had fresh data on jobless claims in the U.S.

JOBLESS CLAIMS

So… initial jobless claims for the week ending April 12 dropped by 9,000, landing at 215,000, while forecasts were pointing to 225,000.

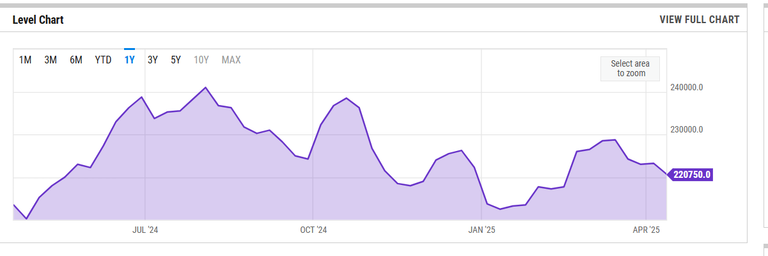

And not only that. The four-week moving average—a “softer” metric that smooths out short-term fluctuations—also fell, down to 220,750 from 223,250. At the same time, continuing claims inched slightly higher to 1,885,000, just a bit above expectations.

Bottom line? The U.S. job market remains strong. Very strong. And that’s not just a number. It’s proof that, despite high interest rates, the economy hasn’t buckled.

POWELL

And this brings us to an important observation. Because you know who’s already warned us that a strong labor market might not be as positive as it seems? Jerome Powell. The Fed Chair.

In his latest speech, he clearly said, “Tariff levels so far are much higher than expected and are likely to have correspondingly greater effects on the economy.” In simple terms? Inflation could rear its head again.

And when does that usually happen? When unemployment is low, demand rises, wages get pushed upward, businesses pass on those costs to consumers, and… yep, inflation can flare back up.

So what’s Powell doing? He’s waiting. He’s not cutting rates. He’s not rushing. And honestly, he’s right not to. Because as long as the data doesn’t force his hand, his cautious approach makes perfect sense. He can’t risk letting inflation surge again—especially in a world where geopolitics are tense and energy prices remain high.

He stressed that “The Fed is prepared to wait until we have greater clarity.” And really, that kind of approach shows seriousness and composure. Because the Fed’s job isn’t to react first—but to react correctly.

P.S A War between Trump And Powell will happen soon!

Posted Using INLEO