PALANTIR

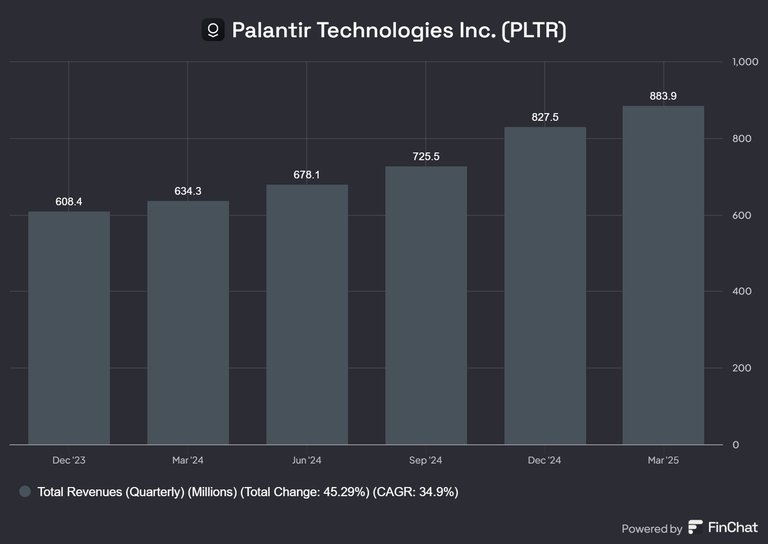

The company announced its first-quarter results on Monday night, and it absolutely crushed it. Revenue grew by 39% year over year, reaching $883.86 million, beating estimates by $21.72 million.

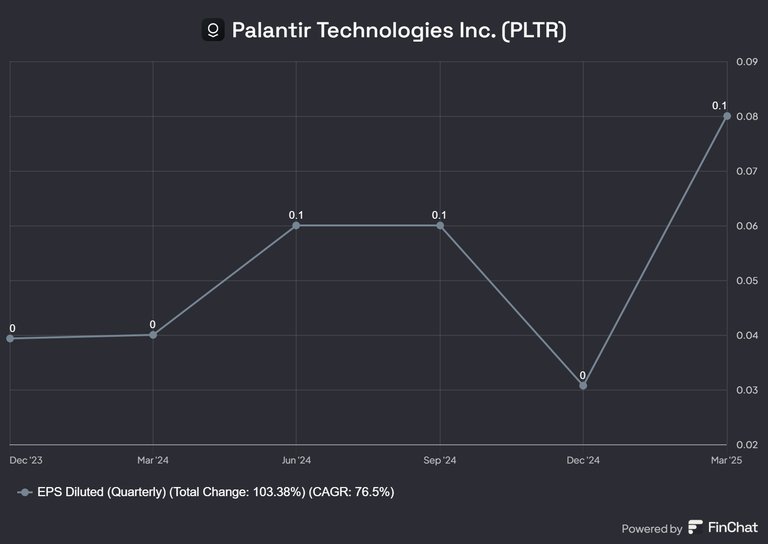

Likewise, earnings per share (EPS) came in above expectations, reaching $0.08 per share versus estimates of $0.07.

But the most impressive part is the upward revision in annual guidance:

Revenue between $3.89 billion and $3.9 billion (above the $3.75 billion the market expected).

Operating income between $1.71 billion and $1.72 billion.

Free cash flow: $1.6 billion to $1.8 billion.

And yet… the stock dropped 12% after the announcement. Why?

Simply put, Palantir’s stock is extremely expensive. Despite its strong growth, it trades at sky-high price-to-earnings (P/E) multiples that can be intimidating. In cases like this, even perfect earnings reports aren't enough. The market expects SOMETHING EXTRA. And if it doesn't see it, it corrects. No matter how excellent the results are, the expectations are already "priced in."

REALTY INCOME

Now, moving on to the second company Realty Income .

Realty Income also reported its first-quarter results, and things look very positive.

Sure, its FFO (Funds From Operations) came in at $1.05, missing expectations by $0.01, but AFFO (Adjusted Funds From Operations) reached $1.06, slightly above the $1.05 the market expected.

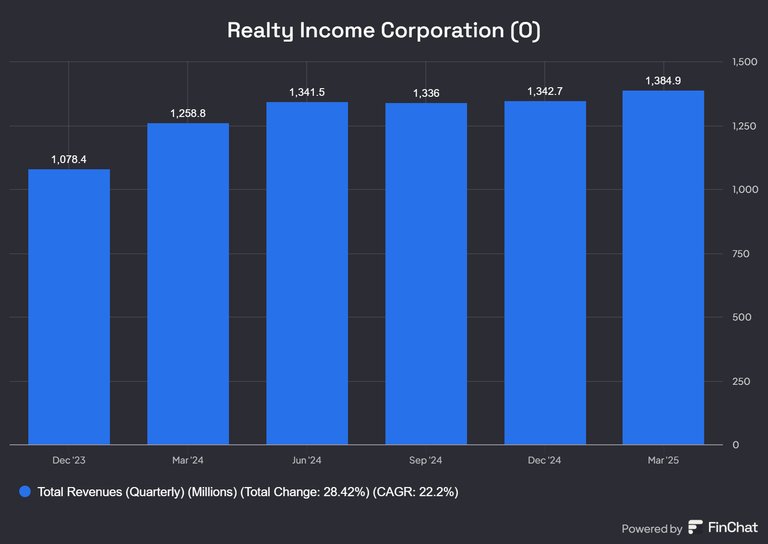

Revenue was also strong, hitting $1.38 billion, significantly higher than the expected $1.30 billion.

And the occupancy rate of Realty Income’s portfolio is at 98.5%, which is truly EXCELLENT for a REIT.

On top of that, management confirmed its full-year 2025 outlook, expecting:

FFO per share between $4.22 and $4.28

Investment revenue of $4 billion

Rental income growth of about 1.0%

Realty Income is what you’d call a value play. It might not have the flashy growth numbers of Palantir , but it’s stable, predictable, and has a consistent dividend policy. Personally, I believe it will show its true STRENGTH when interest rates start to drop aggressively. Its business model is built around low borrowing costs, and every rate cut acts like a growth booster.

Long Story Short:

Palantir is soaring, but overvalued.

Realty Income is steady, preparing for a breakout when the environment becomes more favorable.

So, what do you say? Growth or Value?

Posted Using INLEO