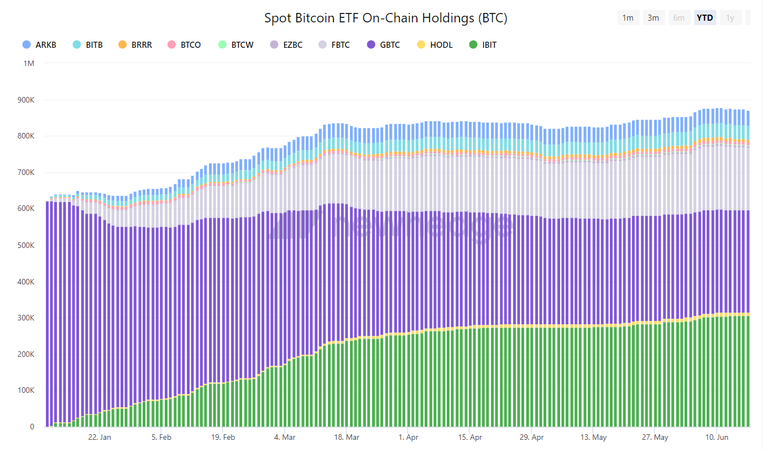

The Bitcoin spot ETFs in the US have shown remarkable growth and influence on the cryptocurrency market everyone is praising the growth and interest the ETF has and we are still extremely early. The ETFs are live for six months now and we have seen infows and outflows as we should and it's time to see what are the numbers and have a safe overview of the impact.

Overview of Bitcoin Spot ETFs and Their Holdings

source

iShares Bitcoin Trust (BlackRock) (IBIT)

- Holdings: 305,614 BTC

- Net Assets: $19.57 billion

- Net Inflows: $18 billion

- ETF BTC Share Ratio: 1.55%

- Market Price: $36.58

- Fee Rate: 0.25%

Grayscale Bitcoin Trust (GBTC)

- Holdings: 279,331 BTC

- Net Assets: $17.84 billion

- Net Inflows: -$18 billion

- ETF BTC Share Ratio: 1.41%

- Market Price: $57.04

- Fee Rate: 1.50%

Fidelity Wise Origin Bitcoin Fund (FBTC)

- Holdings: 168,075 BTC

- Net Assets: $10.72 billion

- Net Inflows: $9 billion

- ETF BTC Share Ratio: 0.85%

- Market Price: $56.14

- Fee Rate: 0.25%

ARK 21Shares Bitcoin ETF (ARKB)

- Holdings: 46,036 BTC

- Net Assets: $2.92 billion

- Net Inflows: $2 billion

- ETF BTC Share Ratio: 0.23%

- Market Price: $64.21

- Fee Rate: 0.21%

Bitwise Bitcoin ETF (BITB)

- Holdings: 37,289 BTC

- Net Assets: $2.39 billion

- Net Inflows: $2 billion

- ETF BTC Share Ratio: 0.19%

- Market Price: $35.02

- Fee Rate: 0.20%

Hashdex Bitcoin ETF (DEFI)

- Holdings: 17,831 BTC

- Net Assets: $1.15 billion

- Net Inflows: $11.73 million

- ETF BTC Share Ratio: 0.00%

- Market Price: $73.39

- Fee Rate: 0.90%

VanEck Bitcoin Trust (HODL)

- Holdings: 10,040 BTC

- Net Assets: $639.37 million

- Net Inflows: $525 million

- ETF BTC Share Ratio: 0.05%

- Market Price: $72.67

- Fee Rate: 0.25%

Valkyrie Bitcoin Fund (BRRR)

- Holdings: 8,372 BTC

- Net Assets: $536.19 million

- Net Inflows: $494 million

- ETF BTC Share Ratio: 0.04%

- Market Price: $18.20

- Fee Rate: 0.25%

Invesco Galaxy Bitcoin ETF (BTCO)

- Holdings: 7,282 BTC

- Net Assets: $445.18 million

- Net Inflows: $293 million

- ETF BTC Share Ratio: 0.04%

- Market Price: $64.22

- Fee Rate: 0.25%

Franklin Bitcoin ETF (EZBC)

- Holdings: 6,148 BTC

- Net Assets: $395.59 million

- Net Inflows: $363 million

- ETF BTC Share Ratio: 0.03%

- Market Price: $37.29

- Fee Rate: 0.19%

WisdomTree Bitcoin Fund (BTCW)

- Holdings: 1,291 BTC

- Net Assets: $82.65 million

- Net Inflows: $71 million

- ETF BTC Share Ratio: 0.01%

- Market Price: $68.18

- Fee Rate: 0.25%

As you can understand, most of the BTC that was once held by Grayscale has moved to BlackRock, probably due to lower fees. The total net inflows for all ETFs as of now are $14.56 billion. What's most significant is that BlackRock now owns 1.55% of the total BTC supply, just six months after launching their ETF. Combined, all ETFs now hold 4.6% of the total supply.

We can all agree that the creation of these ETFs has brought significant buying pressure from players who, just four years ago, were laughing at the idea of buying BTC. Now, they are buying in large volumes. Despite BTC's increased legitimacy due to these ETFs, many people are still hesitant to buy because they see it as gambling and lack knowledge. However, they will likely learn soon enough.

Posted Using InLeo Alpha