When we talk about dividends, we focus on three key characteristics: (a) safety, (b) consistency, and (c) growth. Let me explain.

Safety, because the dividend should be comfortably covered by the company’s earnings. If a company earns $1 million and pays out the entire amount as dividends, there’s risk involved. If earnings drop one year, the dividend won’t be sustainable.

Consistency, because we want a company with a proven track record of paying dividends—and ideally, increasing them year after year. A solid dividend history is always a positive sign.

Growth, because dividend yield should increase at a rate higher than inflation to preserve the value of our passive income. If the dividend remains stagnant, it won’t be enough to sustain us in the long run.

RTX CORPORATION

RTX operates in the aerospace and defense industry.

So, what does RTX do? It manufactures commercial and military aircraft, transporting 11 million passengers daily!

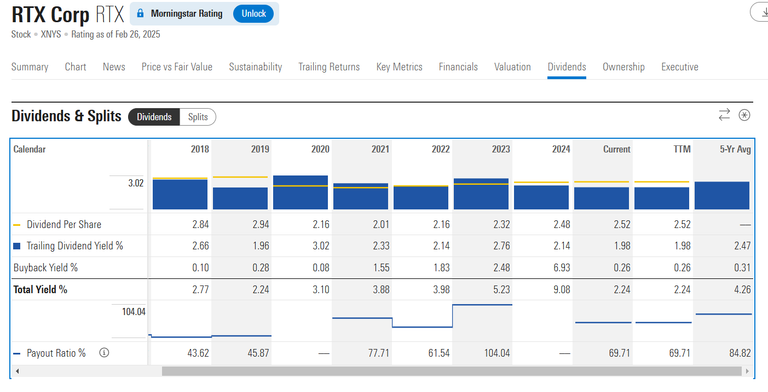

Let’s check the three criteria:

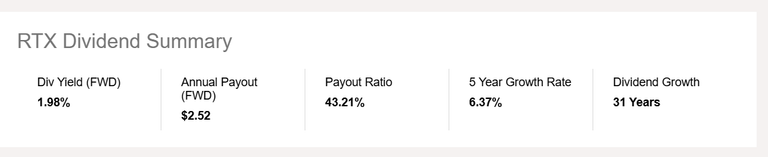

- Safety: Its dividend is extremely secure, as it accounts for only 43% of earnings.

- Consistency: The company has been paying and increasing dividends for 31 consecutive years.

- Growth: The dividend has grown 6% annually over the past five years.

And let’s not forget, the average inflation rate over the last 25 years is 2.5%, meaning RTX ensures that our passive income grows more than twice as fast as inflation.

And the best part? Defense is a highly stable industry. No matter which government is in power, military spending doesn’t decrease.

VICI PROPERTIES

My second pick is Vici Properties , a real estate company focused on Las Vegas.

Vici owns 93 properties, which it leases to legendary casinos and hotels. I mean, what else would they lease them to in Las Vegas, right? Anyway!

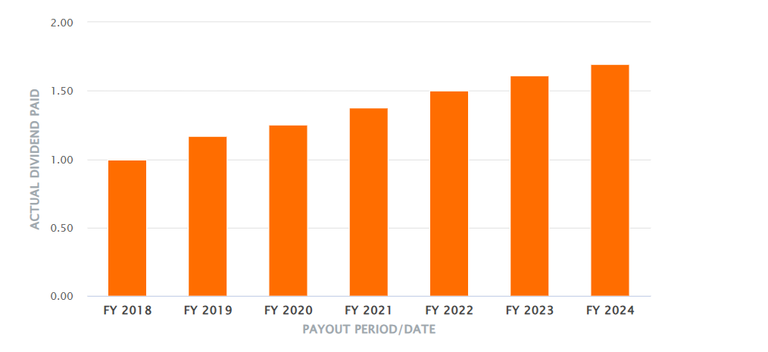

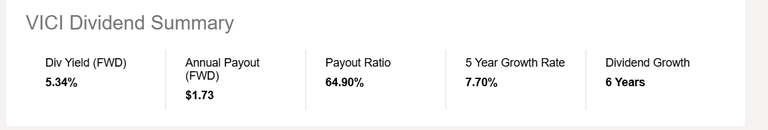

Looking at my criteria, Vici checks all the boxes:

Safety: It offers a 5.7% dividend yield, with a payout ratio of just 64%.

Consistency: It operates under long-term lease agreements, ensuring predictable revenue streams.

Growth: Its dividend has increased 7.7% annually over the past five years.

In short, an excellent dividend play in the real estate sector.

Posted Using INLEO