The moment you decide what to hold and what to sell, you're not just managing capital—you're casting a vision of the world to come. Asset allocation is not simply the rational arrangement of instruments to optimize return for a given level of risk. It’s the performance of a belief system under conditions of uncertainty. It’s an act of divination.

Every portfolio is a worldview. Every weight, every instrument, every omission, says something—not just about the allocator’s goals, but about what they think is possible. Or inevitable. Or collapsible. Even a so-called passive portfolio is a prophecy of persistence. It says: the system will hold, the rails will hum, the growth will compound.

When I help someone manage their assets, I begin by unearthing that prophecy. Because it’s always there—implicit, buried in habits or inherited templates. And until it's made conscious, it can't be sharpened.

The Hidden Story in Every Allocation

Think of any portfolio—yours, your neighbor’s, your DAO treasury. Strip away the tickers, the dashboards, the asset classes. What remains is a narrative scaffold: bets on what will endure, what will fail, what will change.

- Holding U.S. equities is a bet on the continuity of U.S. corporate dominance and regulatory stability.

- Holding ETH is a bet on Ethereum not only surviving as a protocol, but thriving as a settlement layer for global value.

- Holding real estate is a bet on geography, private property rights, demographic stickiness, and physical infrastructure.

- Holding gold is a bet against states, and for metal as myth.

These are not neutral positions. They are mythic commitments—though most people wouldn’t describe them that way. But the truth is this: you cannot allocate without belief. Even indifference is a bet.

The Temporal Shape of Belief

Allocation is also a temporal stance. Different assets encode different visions of time.

- Bonds anchor to fixed timeframes and conservative return.

- Stocks stretch into the future, compounding on systemic assumptions.

- Crypto assets often bet on acceleration—rupture, replacement, reinvention.

- Stables freeze time, holding the present in place while waiting.

So when someone says, "I'm 80% BTC and 20% cash," they’re saying more than “I’m long Bitcoin.” They’re saying:

I believe in rupture, but I need ballast. I’m convicted, but not ready for full exposure.

When someone holds 100% in diversified index funds, they’re saying:

I believe that markets as currently structured will outlast my lifetime.

I often sketch this out with people: not a pie chart, but a temporal map. Which parts of your portfolio are living in the past? The present? The near future? The long arc?

If you’re holding instruments that assume a future you no longer believe in, you’re not investing—you’re memorializing.

Helping People Translate Worldview into Allocation

This is the work: turning belief into practice. And it usually starts by surfacing what someone actually believes, not what they think they should believe.

I don’t ask, “What are your financial goals?” Not right away.

I ask:

- What do you trust?

- What feels fragile to you?

- Which institutions do you believe will hold?

- Which do you think are already dead, just not buried?

Each answer hints at a different allocation:

- If someone trusts decentralized protocols but distrusts governments, they may want exposure to crypto-native assets, peer-to-peer rails, and self-custody solutions.

- If someone believes in the resilience of cities but the fragility of currencies, they may want real estate and commodity exposure.

- If someone sees climate collapse as inevitable, they might want land, water rights, or even regenerative finance assets.

There’s no perfect match. No oracle printout. But the goal is to help people recognize that allocation is not separate from ethics, politics, or intuition. It’s a mirror of self.

Belief, Constraint, and the Ritual of Allocation

Even the clearest prophecy has to pass through real constraints:

- Limited liquidity

- Platform risk

- Transaction fees

- Emotional volatility

- Regulatory exposure

So helping someone allocate isn’t just about ideology—it’s about alchemy. Turning conviction into configuration under material pressure.

Someone might say:

“I believe Ethereum will be the backbone of global settlement.”

But they only have $5,000 and live in a country with capital controls. So we build a viable subset of that belief—maybe:

- A local wallet with L2 exposure

- Some yield-generating ETH staking derivative

- A fallback position in stablecoins

It’s still the same prophecy—but grounded.

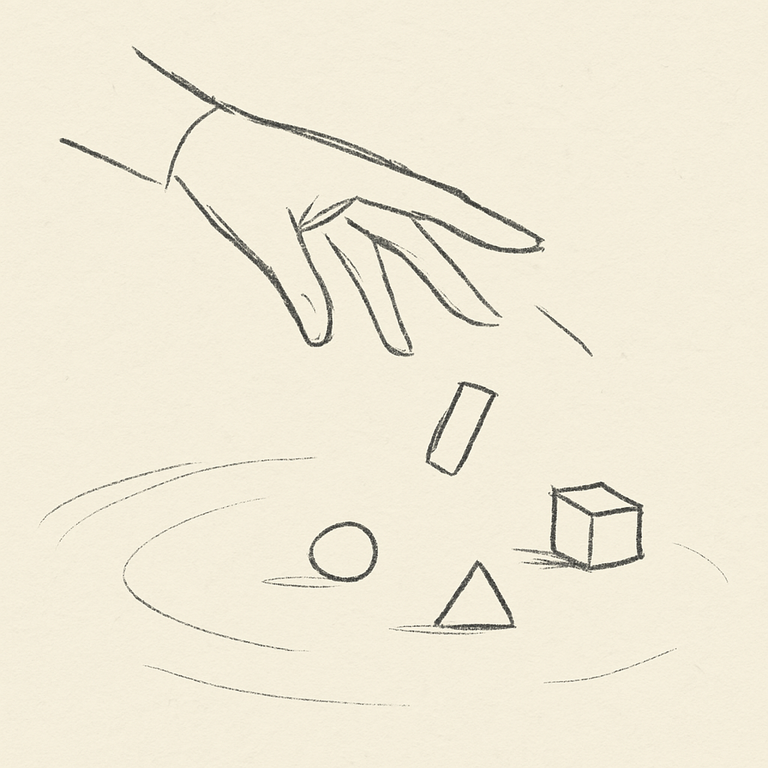

This is where the analogy to ritual deepens. Ritual is never pure. It is symbolic, but also material. A rite doesn’t bring about a future by magic—it aligns the actor with the shape of that future. So too with portfolios.

Allocation is the ritualized form of economic prophecy.

Prophecy, Not Prediction

I want to draw a crucial distinction here: prophecy is not prediction.

- A predictor gathers data, computes likelihoods, and bets.

- A prophet speaks from conviction, not certainty.

To allocate prophetically is not to say “I know what will happen.” It’s to say:

“Given what I believe, here’s what I must do.”

This is especially important in decentralized finance, where data is often noisy, infrastructure immature, and risks asymmetrical. Here, beliefs matter more—because you're often stepping into spaces before the rails are smooth.

DeFi requires prophetic action. There’s no clean backtest for an emergent system. But you can still allocate wisely, if you understand what future you’re aligning with.

Reflexivity and the Limits of Conviction

There’s danger, of course, in belief. At some point, people begin believing their own prophecy too deeply.

They stop revising. They stop testing. They allocate not to express their worldview, but to protect their self-image.

I’ve seen this many times:

- An allocator becomes a maximalist.

- A DAO treasury hardens its thesis long after the narrative has shifted.

- A retail user rides a collapsing token into the ground out of loyalty.

That’s not conviction. That’s ego.

The key, always, is reflexivity.

Build feedback into your allocation:

- Did this asset behave the way you believed?

- Has your belief shifted? Should your portfolio follow?

- Is your allocation still prophetic—or is it dogmatic?

A living portfolio is a conversation. Between you and the world. Between your beliefs and the unfolding real.

Closing: What Are You Allocating Toward?

So I’ll leave you with this:

Look at your portfolio. What future is it aligned with?

Not just in terms of growth or security. But in terms of belief. Does your allocation reflect the world you think is coming? Or the world you’re afraid to leave behind?

Because every allocation is a prophecy.

Whether you own it or not.

Better to speak it clearly.

Posted Using INLEO