Bitcoin was never meant to be deflationary, but Michael Saylor’s buying strategy changed that. Here's how one man’s bold move reshaped how we view BTC's supply.

Michael Saylor’s Impact on Bitcoin's Supply

Bitcoin’s original design never claimed it would be deflationary. It simply had a fixed cap: only 21 million coins will ever exist. New coins are mined daily, so the supply still grows. But something interesting happened — not through the code, but through human behaviour.

One person, Michael Saylor, has made Bitcoin feel deflationary. Not by changing its rules, but by how he and his company, MicroStrategy, approached owning it.

Understanding Deflation in Crypto

In simple terms, something is deflationary if its supply keeps shrinking. Like BNB, which destroys coins to reduce how many exist. Ethereum tried a similar model too, but its success has been mixed.

Bitcoin doesn’t destroy coins. Miners add around 450 new BTC every day. So technically, it’s not shrinking. But when someone buys more coins than are being created — and never sells them — it changes the whole picture.

MicroStrategy’s Bold BTC Strategy

As of May 2025,

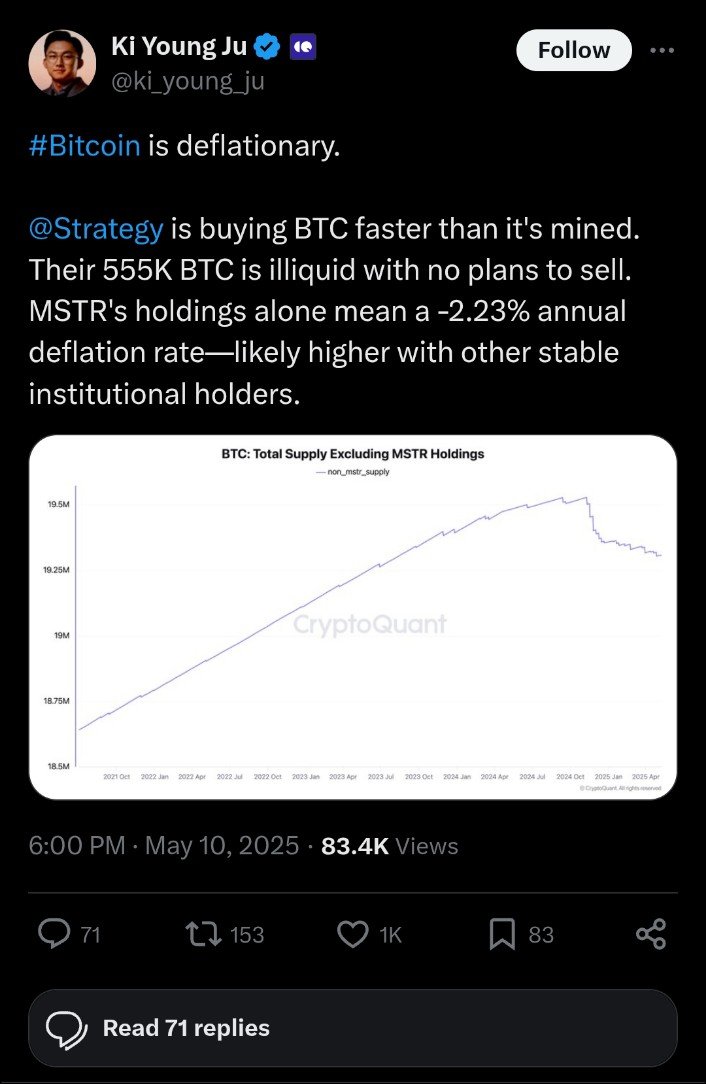

As of May 2025, Saylor’s company owns over 555,000 BTC, a massive chunk of the total supply. Even more interesting is that they don’t sell; they just keep buying.

According to Ki Young Ju, CEO of CryptoQuant, this HODL mindset has turned MicroStrategy’s holdings into something like a “black hole” for Bitcoin. Coins go in, but they don’t come out.

How This Affects Bitcoin’s Supply

If MicroStrategy keeps buying faster than new BTC is mined, it reduces the liquid supply, creating a type of artificial scarcity. Ki Young Ju estimates this creates an effective deflation rate of about 2.23% per year just from one company’s actions.

And when other institutions do the same, buy and hold, he effect becomes even stronger.

Why This Matters for Bitcoin's Future

The more Bitcoin is taken off the market and held long-term, the harder it becomes to buy. This can increase demand and potentially raise price over time.

It also shifts Bitcoin’s image. From a speculative digital asset, it starts to look more like digital gold — limited, rare, and tightly held.

Final Thoughts

Michael Saylor didn’t change Bitcoin’s code, but he changed its economics. By buying more than what is mined — and refusing to sell — he’s helped Bitcoin act deflationary in practice, even if not in theory.

It shows how individual actions, when big enough, can shape the path of a global asset.

Inspired by Scr

Posted Using INLEO