Hello and welcome to this weeks LBI Holdings and Income report. LBI is a pooled investment token based on HIVE with a range of assets backing its token. Each LBI token represents a share of the assets, and the value of that share is published daily on inleo.io as a thread. All you have to do is check our profile page to find the most recent "Asset backed Value" for the token.

LBI has just recently come under new management, and we are working on raising its profile, converting it into a token that shares a portion of its income each week with token holders, while also selecting investments to maximize growth. LBI's roots are firmly planted in the @spinvest ethos of "get rich slowly". We don't chase amazing returns and massive gains, we look for solid investments, long term growth and the magic of compounding.

This is the third report since I took over as manager of the fund, and we are settling in to our new path, and more pieces of the puzzle have been put in place this week.

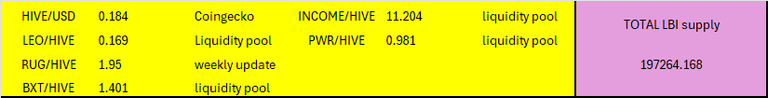

Here are the current prices used at the time of this report.

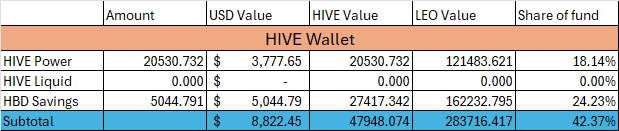

HIVE Wallet.

Our HIVE Power has grown by 125 HIVE this week, from a combination of curation, inflation and post payouts. HP is up a little as the overall share of the fund also, from just under 18%, to just over. I'd expect that to continue, as I'm working hard on content creation and our posts have been very well supported over the last couple of weeks.

HBD dropped a bit, as I pulled 100 out of savings to have the funds to pay the coder for setting up the dividend distribution. This should happen and be ready to go over this week, and so next weeks report should come just after the first dividend gets sent out. Fingers crossed that all works as planned. We also get our HBD monthly interest next week, so we shall see HBD start to climb slowly.

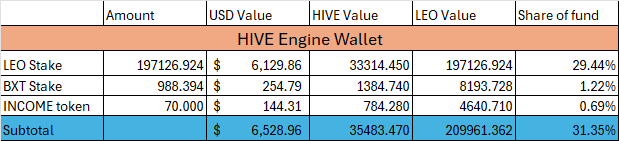

HIVE Engine Wallet.

252 LEO added to our stake this week, from our @leo.voter delegation. I did drop the delegation back a bit during the week - to 15K HP from around 17K. This was done as I want to grow the delegation to the Hive Power Ventures project run by @empoderat to build our PWR. Details on that wallet are further on in this post.

No change to our INCOME holding, and I added a little BXT from the weekly "reinvestment" funds from the income we collect.

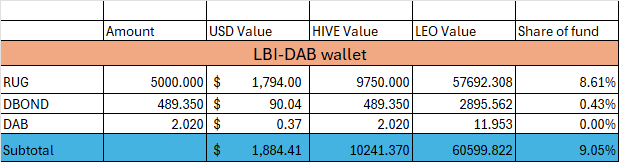

@lbi-dab Wallet.

This weeks RUG payout of DBONDS was less than last. We received just over 100 for the week. This is still an awesome APR of around 50% on our RUG investment. The DBOND all remain staked, and slowly we will mint more DAB. Only a couple in the wallet so far, but that number will grow and the growth will accelerate over time, as our DBOND grows. Income coming out of this wallet is tiny, as you will see below, but again will grow over time.

The value of the RUG dropped slightly, but as it is backed by funds invested off HIVE by @silverstackeruk it is dependent on the broader crypto market.

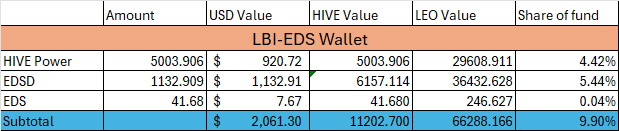

@lbi-eds wallet.

This is the slow and steady wallet for us. A few HIVE from inflation, 18.5 EDSD added by using our HBD from post payouts. In the end, 15.93 EDS came in this week. Steady growth which will continue every week.

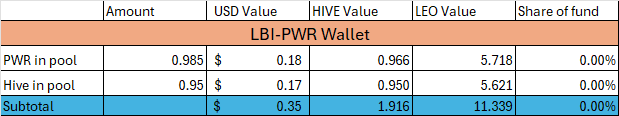

@lbi-pwr Wallet.

The new addition to the report this week. We have delegated currently 2000 HP from the main wallet to @empo.voter, which generates us PWR each day. This gets moved over to this wallet, and half swapped to HIVE and the added to the pool. Not even a blip in the wallet yet. In the coming week, I will be able to increase the delegation, to boost the daily income.

To read more about this wallet, and our long term plans, this post has all the details:

https://inleo.io/@lbi-token/setting-up-our-next-investment-jf8

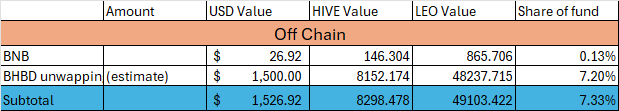

Off Chain.

No change here. The HBD unwrap is still a guess, and our ticket is still in the queue for the LEO team to address when it is our turn.

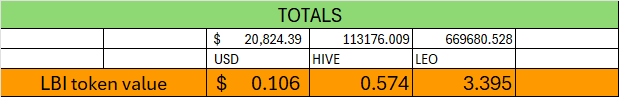

Totals.

Pretty stable week really. Not much change in these outcomes from last week. We grew our assets, as you can see from the sections above. But the overall values didn't change much from last week.

The fund held over $20K USD value for the week, and hopefully improvements to the HIVE and LEO prices will come soon.

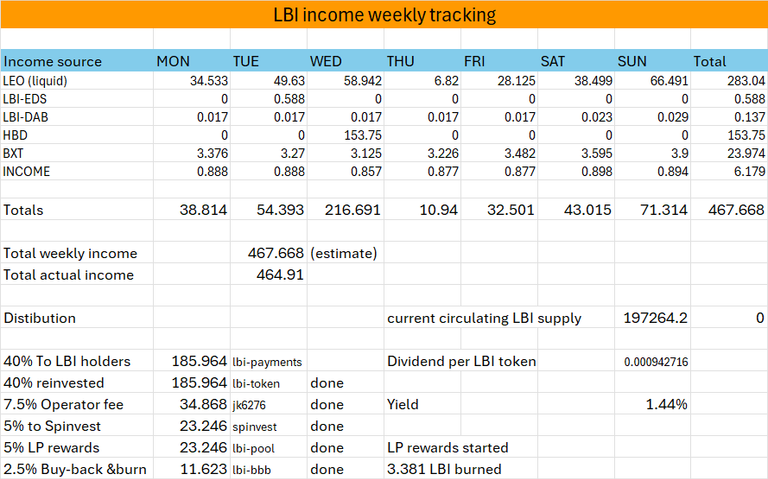

Income

Here is the full weekly breakdown of our income. Remember, this does not include much of what would previously be counted as income. In fact, I put out a post this week showing a few easy ways I could use to have a vastly higher weekly income amount.

https://inleo.io/@lbi-token/the-hardest-part-now-is-jf1

Our liquid LEO post and curation payouts are a little lower than last week, but last week was a weird week with no payouts for days, and then a big one at the end of the week. This section is heavily dependent on my activity level for the week.

The EDS and DAB wallets are still a tiny amount on the weekly income at this point.

HBD income dropped, in line with a change in plan in response to the HBD interest rate change.

So total income was under 500 for the week. This gives us a good baseline to grow from.

You can see how the income distribution works, and most of the pieces are now in place. The last remaining thing to get up and running for our new set up is dividends. As you can see, the yield is not big. But it will be 100 % sustainable. And income should grow every week, as our passive income sources grow. The liquidity pool has grown nicely, and it has had funds seeded into it now for yield. Remember, LBI added to the pool will still count for your weekly dividends, when they start (hopefully next week).

3.381 LBI bought back this week, and sent to null. Every week, the token's circulating supply will shrink by a small amount. LBI is deflationary, with a growing asset base and income. Now it is just a matter of time before numbers go up.

If you have any questions or feedback about anything in this post, feel free to slide in to the comments section.

If you want to compare this weeks results to last week, here is the update post for last week:

https://inleo.io/@lbi-token/lbi-weekly-holdings-and-income-report-week-2-12-aug-2024-9nq

Thanks for checking out this weeks detailed income and asset update, have a great week everyone.

Cheers,

JK

@jk6276

Here are some of our other posts to learn more about LBI:

There was also a nice post put out by @gadrian about LBI's new direction. I love seeing content about LBI coming out, and look forward to more over time. Do check out Gadrian's post and show some support:

https://inleo.io/@gadrian/putting-lbi-to-work-jpf

Posted Using InLeo Alpha