If you live in a developing country, you are aware of how influential politics is on the economy of the country. Unfortunately, when we look at the global ecosystem, we see that almost all countries are progressing in a similar way. The distinction between developed and developing country policies that you may have noticed before is becoming more and more mixed up every passing day.

As political turmoil continues, unfortunately, the investors have to keep up with these changes and arrange their portfolio according to the latest updates. A balanced portfolio, as most of us follow, is directly exposed to the risks and the "black swan" situations that we think we may encounter. We usually follow macro trends in the first place and try to predict what may happen in the future to plan our short-term positions accordingly. However, the unknown and unpredictable nature of what we call Politics makes this situation almost impossible.

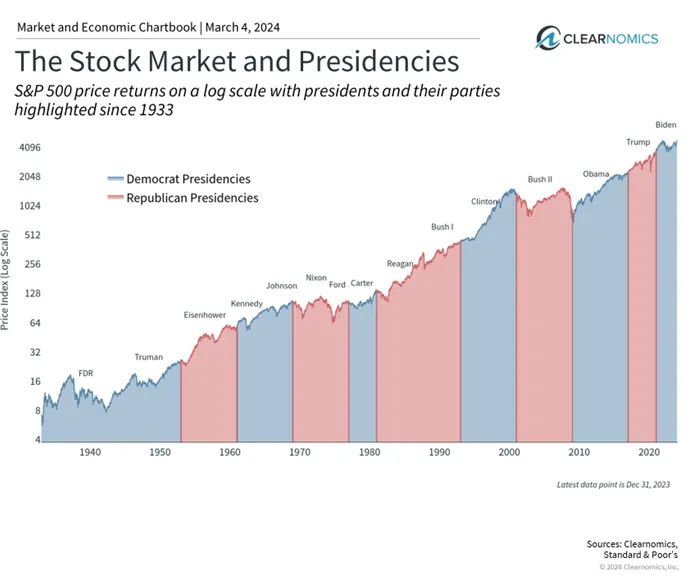

After gaining a certain investment experience, you actually understand how easy it is to read the financial system. Especially, how different policies are followed by people who fulfill their government duties during election times. And at other times; In other words, when you realize when they prefer to face the bitter medicine, you observe that acting together with them is the most rational way.

No leader wants to enter an election with a tight monetary policy. We should all accept that: Inflation brings happiness to many. This is the only basis for those who invest in inflation to achieve leveraged wealth. Every president wants to be able to continue what he is doing or be remembered well so that he can run again in the next election.

When we come to the present day, things seem to be moving in the same direction. For example, it is no coincidence that we are all following Trump policies in shock. Instead of spending too much ammunition to take a bloated market even higher before him, Trump wants to do things that will make his own policies easier by first addressing what he calls big problems. This is crypto and trade deficit. First, the ongoing cases on crypto were dropped one by one, paving the way for softer regulation. Now, he plans to continue discussions on customs agreements with other countries in order to eliminate the trade deficit and to establish a sustainable and healthy trade network for America.

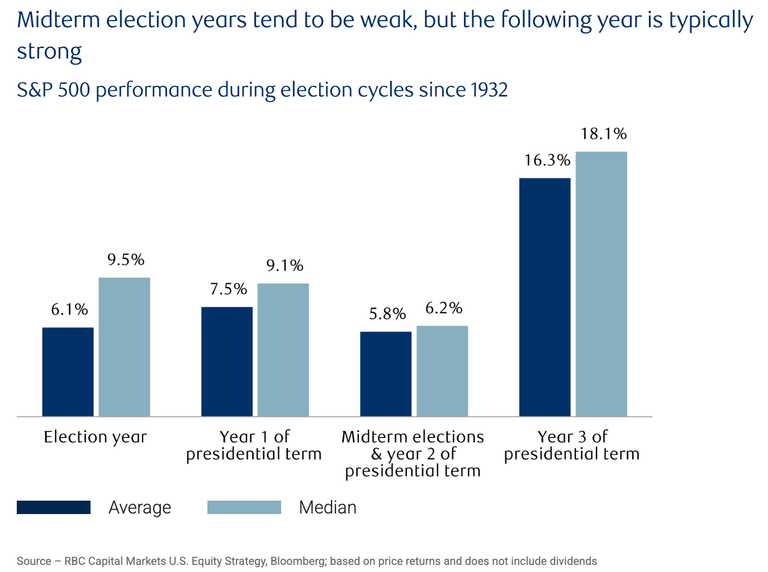

Most of the attention of midterm elections is focused on the two chambers of Congress: the U.S. Senate and the House of Representatives. Members of the House are elected for two-year terms, so all 435 seats are decided during the midterm elections.

The midterm elections are approaching. Although Trump will continue as president, it is very important for him that Congress is behind him. Investors already saw Trump as a market friend. It will not be difficult for him to regain the same reputation.

Of course, the upcoming midterm elections are also on Trump's mind. I believe that this ongoing uncertainty will soften with the approach of the midterm elections and that greener markets will begin to show themselves. When making my investments, I base my term expectations on this. Since I believe that the mid-year and 2026 periods will be better for us, I am currently trying to follow the thin markets from afar and ignore short-term fluctuations.

What do you think about arranging your investments according to the election cycles?

Share your thoughts below 👇

Hive On ✌️

Posted Using INLEO