If I could just take a time machine back to when I first started with decentralized finance and crypto to give my past self some advice, oh boy I would change so many things. Firstly, I would remind myself to take profits more often or at the very least remove initial investment capital, especially when taking a photo screenshot. In retrospect, you always take screenshots of your portfolio when you're at an all-time high and feeling confident.

Mainly I would give myself the advice to always keep an open mind and be hungry to learn new things- new projects, protocols, blockchains and technologies at all times. By pigeon-holing yourself into a single chain or project you are severely limiting your upside potential and opportunities.

This starts with knowing where to even look in the first place. In this confusing and messy crypto world we live in you have to be extremely cautious about what you do and who you listen to. There are scammers lurking in every single nook and cranny of this industry. Shillers, fake promoters, phishing attempts, spyware... the list goes on and on. Having legitimate sources is of utmost importance and this is why I always cross-reference. You cannot blindly trust social media influencers when they often have their own best interests in mind and you are the exit liquidity for them. Trust your own analysis, but don't get too excited about any particular project.

So where do you even begin you may ask? For an absolute beginner you should familiarize yourself with the basics from CoinmarketCap

or CoinGecko

Both of these sites now offer a "DeFi" tracking page since the main sites are for more mainstream and legitimized, established cryptocurrencies. These DeFi pages are like the minor leagues in crypto where anyone can create a pair without any restrictions, and it will show up once it gets volumes and the data is recognized in the system.

This is like the wild west of crypto where so much can happen, so always be careful and use wise operation security when it comes to your wallets and how you store your data:

- Don't ever click random links from unknown sources

- Never approve or sign transactions you're unfamiliar with

- Never rush into something when it comes to your wallet and crypto

- Use common sense first, if it seems too good to be true it probably is

- Assume everyone is trying to scam you until proven otherwise

- NEVER, EVER CLICK FREE MINT NFTS FROM TWITTER this is the most common wallet draining tactics

~

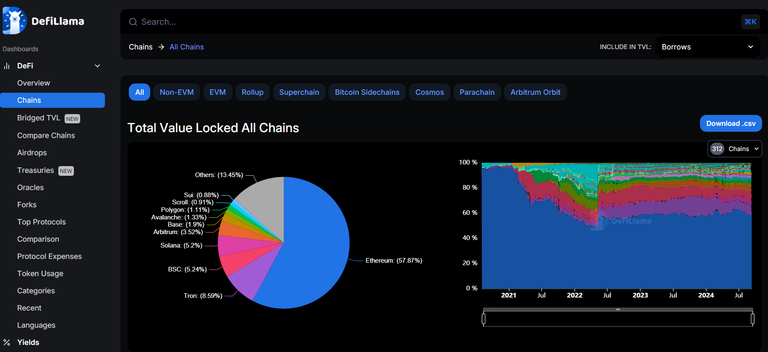

Now lets proceed to the slightly more advanced parts here and jump right into the various protocols and blockchains which support decentralized finance. My absolute favorite website for tracking and collecting this type of information is DeFi Llama

There is a lot to unpack from this website so one of the most useful pages is the Chains tab (CLICK HERE) which publishes all of the Total Value Locked by blockchains among other data. This gives you a visual on how everything is laid out, who is leading the pack and where each project lies in this matrix. Ethereum and its Ethereum Virtual Machine tech (EVM) is the king of DeFi.

Now that you know what exists in this space of DeFi blockchains you can start to get some of the necessary tools to interact with the blockchains themselves. At its core you need to understand just a few concepts:

- What is a web3 wallet (DEX v CEX trading)

- What is "gas" and how it's used for on-chain interaction

- Connecting to web3 enabled sites and decentralized applications called dApps

- Performing transactions using a web3 wallet and gas

- Backing up your seed phrase*

Once you understand these basic ideas and how they relate to your crypto strategy you can begin to look for some opportunities and how to deploy capital to make a return on your investments.

There are many different strategies in DeFi and this will require its own dedicated post to do a proper deep dive. To give a few quick examples, this is how I prefer to use DeFi:

- Liquidity Pair (LP) providing on exchanges like Uniswap

- Collateralized lending using ETH or ETH-like asset to borrow stablecoins

- Perpetual swap leverage contract trading

- Staking for a yield on my deposited assets

- Airdrop hunting by being an early adopter for new protocols

These are relatively advanced strategies for the common crypto user to get involved in, so I intend to go into some deeper dives in the future to cover this material fully.

For now that's a wrap on the part 1 - stay tuned for Tips and Tools of the Trade Part 2, where I will explain some of the concepts from above so you can become an DeFi pro in no time!