My dear readers, as a trader, I want to share some rules and ways that make trading easy and successful. Successful trading means doing your homework consciously and keenly. It is a must to understand how the market works, always keep an eye on economic news because the news effects approximately more than 30 percent, and keep an eye on company financials and global events that can affect prices.

If you want to avoid big losses, it's important to manage your risk. This means using tools like stop-loss orders and spreading your investments across different assets.

You should first make a trading plan that outlines entry and exit strategies, risk tolerance, and goals. This is essential for disciplined trading.

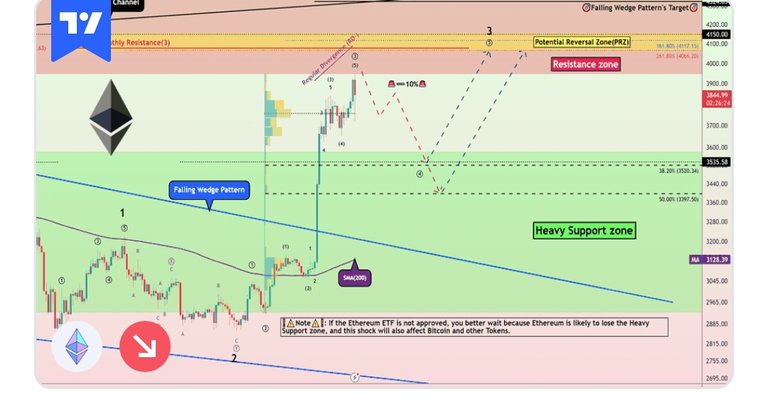

Using technical analysis tools, such as charts, trends, and patterns, can help traders make better predictions about future price movements. By studying historical data, traders can identify patterns and trends that provide insights into how prices might change in the future. This approach helps them make more informed decisions when buying or selling assets.

Successful traders maintain emotional control and avoid impulsive decisions driven by fear or greed. Sticking to the plan is key.

Timing is everything in trading. Knowing the right moments to enter and exit trades is crucial for success. This requires constant vigilance in monitoring market conditions, staying updated with the latest news, and closely observing technical indicators.

By paying attention to these factors, traders can make timely decisions that enhance their chances of profitability and reduce the risk of losses. Making well-timed trades is a skill developed through experience, patience, and continuous learning.

The content I shared with you guys is based on my education and knowledge. I wish you people will appreciate this post and reblog if you like it. Thanks for sticking till the end.