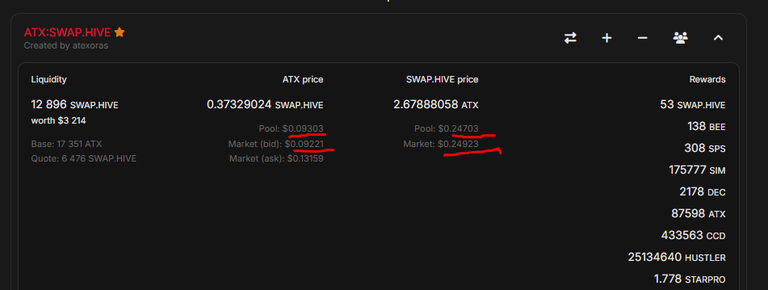

Don't forget that the APR shown on rewards (which anyone can add to the distribution), varies also (in this case because I have ATX being distributed via rewards) depending on the price of the token on the market SWAP.HIVE:ATX... which, if you compare right now, it has almost no bids... and makes it kind of "false" the values shown on the pool.

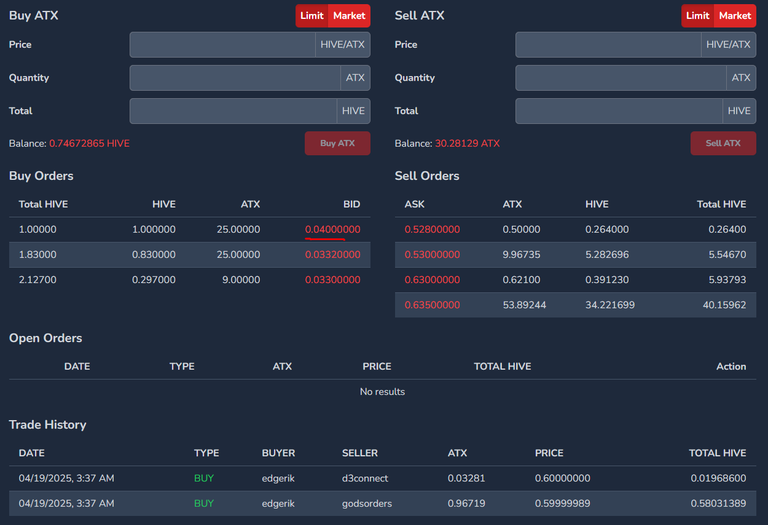

And the market is like this:

It takes just a tiny bid for the values to constantly change...

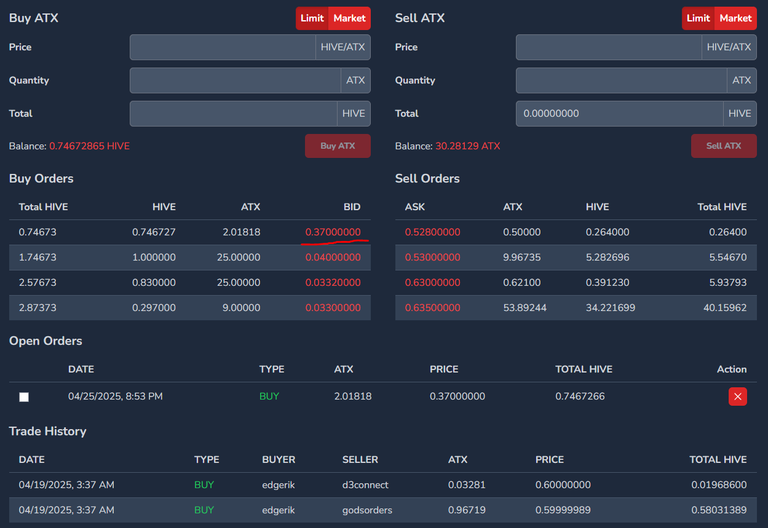

I am going to put one just to explain to you...

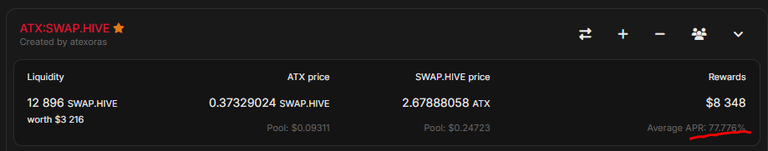

There you go... and I have used a value for the bid that is equal to what the pool has... and voilá, the pool values become this...

Because most of the liquidity is in the pool (either as liquidity or as rewards to be distributed), the market (SWAP.HIVE:ATX) pressure is very unrealistic. And when this happens one has to pay attention to those things (I know, its not damn easy to understand).

I didn't create this for investment, but everyone is free to use it however they wish. Instead, I created these things to teach people... literally like what I am doing now.

Hope you have learned something. And if you have any further questions, let me know.