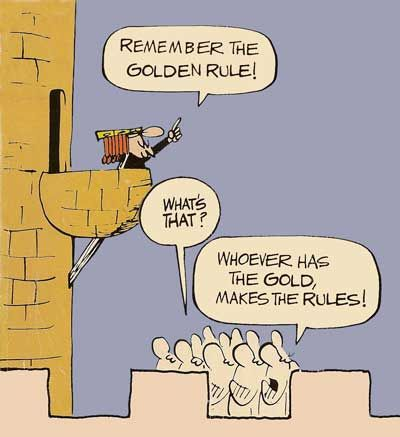

Not to be confused with 'the top 1% rule the world', rather, one should never put more than 1% of their total net worth into a shiny new crypto toy.

We are likely all guilty of breaking this rule.

As someone who bought ICOs in 2018 and heavily invested in things like Steem at $2.60, $1.60, $0.90, etc... we've all been grossly overextended in our investments at one point or another. It is easy to get carried away when the potential gains are exponentially visible, seemingly at our fingertips. If only the world realized how important XYZ crypto was to the world the day after we went all in. Unfortunately, that's not how it works.

When it comes to investing in new things: I have a new rule for myself. The self-explanatory 1% rule: don't spend more than 1% of your net worth on a new investment, no matter how exciting or profitable it may seem.

In the rare case that you make x1000, it's not going to matter that you didn't go all in on that particular asset. If you spent 1% of your stack and then that 1% goes x1000, you just 10xed your stack. Easy. Good job! You're doing alright!

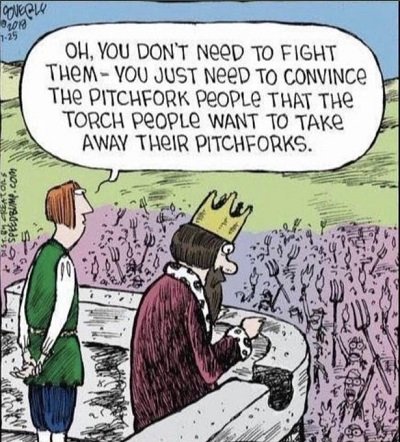

Meanwhile, if you continue risking it all over and over again, it's only a matter of time before the double down fails and you lose everything. The key is balance; the key is decentralization and mitigating risk while maintaining reward.

The biggest reason for writing these words today is the upcoming CUB IDO for the launch of CAKEPOP token. This asset is not officially endorsed by the LEO or CUB community, and it doesn't have to be. There is no risk to CUB, as burning tokens is always going to be a net positive on our end.

The same cannot be said for those who choose to participate in these super risky startups. These random tokens will certainly flourish or expire depending on fate, and I imagine many of them will have a relatively short lifespan just like we saw in the 2018 ICO crypto winter extinction.

On the other side of the token, we aren't in 2018. We're in the 2017 foothills +4 years, where everything is going to moon no matter what and the mega-bubble hype will explode into euphoric absurdity. At least that's what I assume will happen again.

Gambling is all about making measured bets and winning on average. In order to win on average one must make a lot of small bets in order to hedge the overall swing of the stack involved. One false move with a big chunk of money can cripple any bankroll, whether it be horse racing, poker, or crypto. Gambling is gambling.

So I may be overhyping CAKEPOP a bit. It seems like it's going to be fun but I would feel partially responsible if someone bought in because of what I said and then got absolutely wrecked. Just the other day I was talking to one of my good friends who wanted to sell LTC at $380 and I told him not to. Oops. He made sure to remind me about it a few days ago. That's not even close to the biggest blunder I've made around these parts. More like par for the course. Not not financial advice.

Where are the best hedges?

Even though CUB is also technically an extremely new startup, many of us can see it's going places, and the dev team has been trusted to forge ahead for years now on the LEO side of things. I still think CUB/BUSD is one of the best places I have to hedge against any potential downside in the market. Even during the brutal crash in May this LP pool was easily able to outperform Bitcoin in terms of losses mitigated. Not too shabby for a platform born in March.

That being said, there are many kinds of hedges. BSC doesn't have much security when compared to the Bitcoin network. BUSD not only depends on the value of USD to remain stable, but also depends on the peg to be constantly corrected by a centralized entity (Binance). There are many many situations where Bitcoin is still the best hedge in the world across the board. We would be wise to remember this as we pile our BTC into random pegged tokens on EVM networks.

There are many different kinds of decentralization and security implementations. If you secure your crypto on ten different hardware wallets, but then proceed to store all the backup seeds in your house, the centralized attack vector here is obvious. Your entire stack is accessible from one location. This might not be an issue today, but give in ten years and millions of dollars later and it will become a wholly unacceptable solution.

Conclusion

There's no reason to bet the farm, as it were, on any investment; past, present, or future. The best way to play these things is to simply dip your toes and see how it goes. Put your money where your time is, and never get lazy with your money, especially after hitting the jackpot and winner's tilt kicks in. Just because our bags are filled doesn't mean we should lose vigilance and start throwing money away at everything under the sun. 'Easy come, easy go' is not a good motto for investers.

Posted Using LeoFinance Beta