It's been a bit of a crazy week for @mrsbozz and I. It all started on Tuesday when we went out for drinks and dinner with some friends from work. Then, on Wednesday we had to rush away from work early so we could get down state to see our nephew play football. Last night we had dinner and a concert that kept us out quite late. Tonight is homecoming at the school district where we work, so we are driving our truck through the parade while kids sit in the back and throw candy.

Tomorrow is more football as one of our other nephews has a game a little closer to home this time, and finally on Sunday we are driving down to Indiana to watch our oldest niece play softball. It's been a mad rush and it feels like we have been away from home more than we have been home. I have a feeling we are going to be even more tired after the weekend than we were before it!

The good news is, in the midst of all of that, I got to have my first Oktoberfest of the year (as you can see in the opening photo), so it hasn't been all bad.

It is time again for another Finance Friday/Friday Finance. This is a series I started where I talk about random bits of financial stuff that I have seen, gathered, or experienced during the week. I hope as a reader you find it informational, entertaining, or both. I also hope it can generate some good discussion and edify the community.

If you have been paying attention, we finally turned that corner this past week and we are more than halfway through September. Right now it's looking like "Uptober" could be very interesting. Bitcoin is sitting at almost $64,000 which isn't great, but it's still better than we have been looking lately.

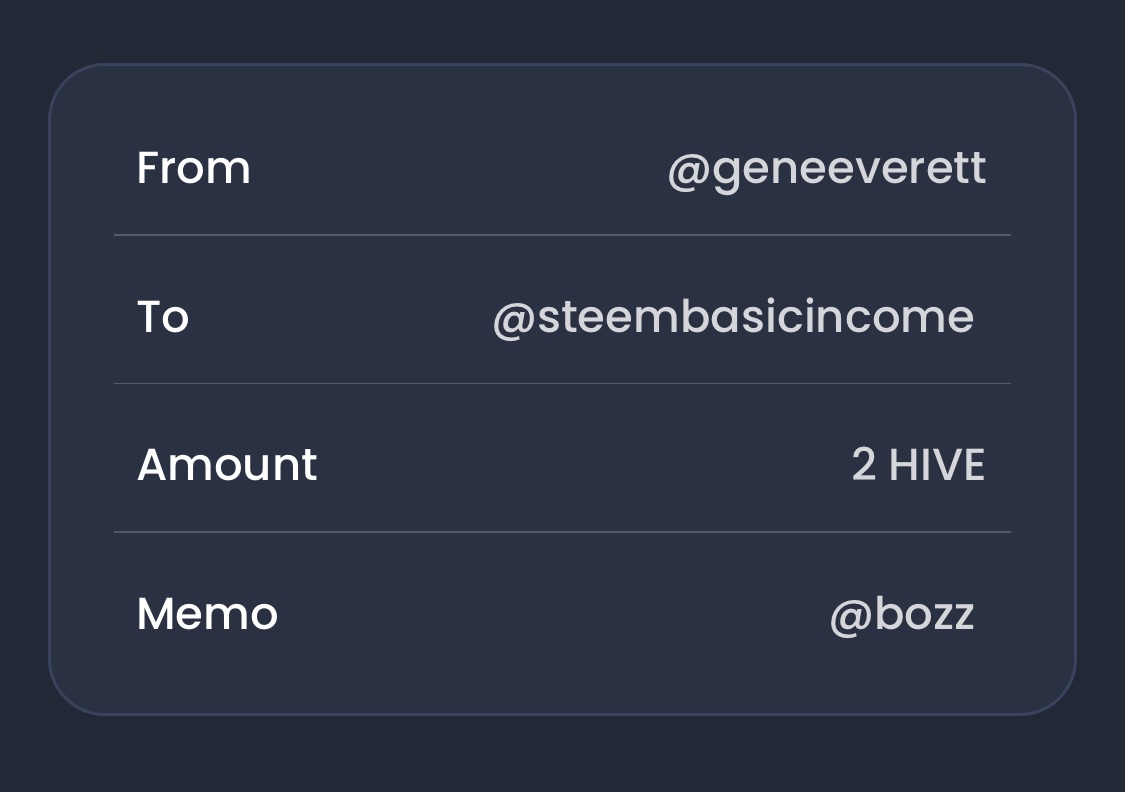

Personally, I kind of hope we see one more dump before things really start ramping up, but that's just me. I've said before that I have some Hive buys sitting out on the market between $.10 and $.16. I'd like to see them get filled, but if I have to cancel them and buy HIVE before it passes the $.25 or $.30 mark, I will.

Capital Gains and Dividends

The potential bull market aside, there is another reason I love this time of year. It looks like about three days ago the company whose investment products make up a large portion of my portfolio released their projected capital gains and dividend numbers for the year. I'm going to cover what I am looking at for you here:

| Fund Name | Capital Gain | Dividend |

|---|---|---|

| AMCAP Fund | 7.5%-10.5% | 100% |

| EuroPacific Growth Fund | 1.5-4.5% | 75%-100% |

| The Growth Fund of America | 6.5%-9.0% | 100% |

| New World Fund | 1.0%-4.0% | 70%-100% |

| New Perspective Fund | 3.0%-6.0% | 90%-100% |

| Small Cap World Fund | ~1.0% | 70%-100% |

| American Funds 2035 Target Date Retirement Fund | 1.0%-3.0% | 45%-60% |

I know that all of this could get thrown out the window depending on how the coming election goes, but it's still interesting to see what my portfolio is going to look like come December 31st when all of that money starts compounding back into my holdings.

This clearly isn't financial advice, but that Growth Fund of America has been a long time anchor of my holdings. I'd venture to guess it's probably 40% of my total portfolio and when you look at those returns which have been pretty consistent over the past 20 years or so, you can understand why. Morningstar rates it as a three star holding, whatever that means...

RWA's and CHEX

I've been saying for a while now that CHEX is one of the tokens I am holding for a hopeful moon shot in the next bull run. Where NFTs and DEFI were the darling acronyms for the last bull run, I think everyone can agree that AI and RWAs are the acronyms for this one. Meanwhile meme coins continue to do their thing across both the bull and the bear.

CHEX is the native token for the Chintai network which has shifted its focus over the past several years to Real World Assets. I saw a couple of tweets the other day talking about how ChintaiNetwork has picked up another white label client named ThisIsDNA and they recently presented DNA Deal Desk at the Token 2049 conference.

The Tweet claims $100M US TVI w/recurrence.

Of course, I take all of that with a grain of salt, but the fact that they are picking up clients and moving forward is exciting. Do your own research as always, but at right around $.13 right now, I still think this token is a steal. The ATH is $.43 and I think in the bull it has the potential to go much higher than that.

Looking Ahead

As far as my plan for the coming months.... Watch some football, throw in some volleyball and basketball, pray for Hive to go up, and beyond that, just wait and see what happens. I realized the other day that my previous "soft targets" for selling crypto might be a little unreasonable. It's been a couple years since I set them and given the increase in token supply for some of my holdings and other factors, I might never realize the numbers I previously anticipated.

For example, I had a soft target to sell 20,000 WAX when it hits $.50. The bear hasn't been kind to WAX and it is currently sitting at $.03. The previous all time high was just shy of $1. Three years ago $.50 seemed like a reasonable number, but given the ice age that has hit the NFT world, the fact that more WAX has been minted between now and then, and a few other things, I doubt we will ever see the previous ATH. $.50 is probably more of a hopeful thing at this point.

I might need to knock that down to $.10-$.20 or something like that.

I'm still bullish on these tokens: HIVE, CHEX, KOIN, POL, COTI, VET, TREX, and a handful of others. Meanwhile, I am hoping to follow the example of my colleagues in the #silvergoldstacker community and start to build up a decent silver portfolio beyond just novelty rounds. I'm talking big fat bars that a disgruntled spouse could use as a murder weapon. We will see though!

Sports Talk Social - @bozz.sports

Posted Using InLeo Alpha

)

)