Yesterday morning, I had planned to go for a run as part of my daily routine, but things took an unexpected turn when I discovered that my shoes had broken down into pieces during the night or rather the last run. This was frustrating because it meant I couldn’t follow through. After some consideration, I decided to reschedule my run for the evening.

Then I headed to the office for work, where I spent several hours focused meetings. After wrapping up my responsibilities for the day, I made the decision to go downtown in search of new running shoes, as the broken ones were no longer practical for an evening run.

The trip downtown was both productive and a bit time-consuming, as I not only found a suitable pair of shoes but also explored some stores along the way.

Thursday marked the fifth birthday of $HIVE, an event that brought a mix of excitement and financial strategy into my life. The occasion was celebrated, which led to significant price drops in the market. While I had planned to take advantage of these opportunities by jumping into trades known as "planks," circumstances prevented me from doing so on time. This disappointment was outweighed by the silver lining of having more funds available for future power-ups. The prices dropping further strengthened my conviction that waiting and investing at the end of March or beginning of April would be a wise move, allowing me to capitalize on potential price increases.

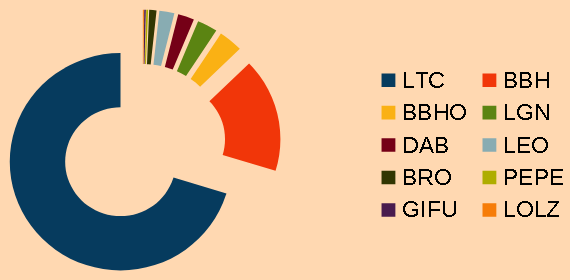

During yesterday’s trading session, $LTC experienced a notable climb, reaching as high as 407 $HIVE before I decided to close some positions from December.

This move was strategic, as it allowed me to lock in profits while still holding onto some positions for future gains. The climb of $LTC had been a long time coming. By closing some trades, I not only secured a profit but also positioned myself to benefit from any further price movements.

This decision was particularly satisfying because it outperformed the interest rates I could have earned on idle funds, making it a financially sound choice for me at that time.