There is nothing complicated about evaluating $LEO as an investment. There is a real business that is bringing in thousands of dollars every single week in a rapidly growing market in the middle of a bull run. All this revenue is designed to flow towards LEO investors. All the transactions are tracked on blockchain. There are no company shares or revenue shares for developers. Developers build because they themselves own a large stake in $LEO.

Does this remind you of developers of BTC, XMR or many successful memecoins? LEO developers are doing the same thing. They are on a journey to reach $100 million valuation or go bust. This is the skin in the game we need to make a massive difference in the world and build strong long lasting projects.

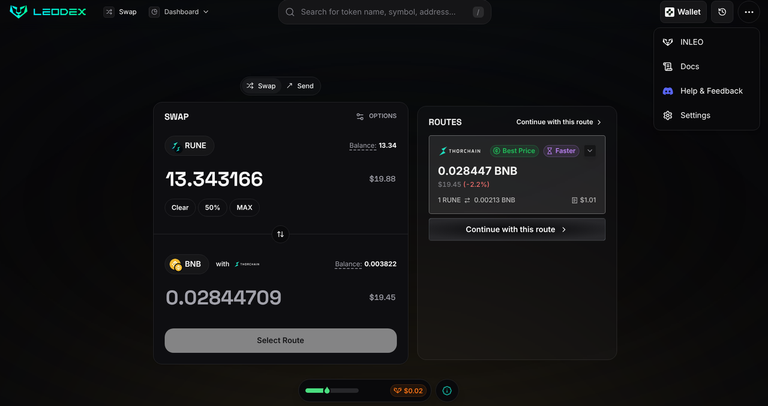

LeoDEX is The Biggest Revenue Source

Look to the right and see that LeoDEX rank very high in terms of user stickiness. I have seen it on top and LeoDEX has been pretty much stuck in Top 5 for a long time. This is a very good sign for long term growth. What we need is recurring revenue from loyal users. There are two places to track LeoDEX revenue.

- xScanner (THORChain + @mayaprotocol)

- Chainflip Explorer (Chainflip)

I don't know of a place to track earnings from Rango and Relay which have the largest and most extensive network of cross chain trading support. These two projects connect both CEXs and DEXs. Neither are decentralized protocols like the other 3 protocols LeoDEX is connected to. 100% of this protocol revenue goes back into $LEO in various forms.

LeoMerchants Extend LeoDEX

The technology has already been built in its basic form. There is more work that needs to be done to make it consumer ready. There are very few projects working on retail POS systems for accepting cryptocurrency and LeoMerchants is the only one that I know to be created by a DEX. All of that volume is going to flow though LeoDEX and earn more Rewards for those who stake LEO.

INLEO is a Superpower for Brand Building

It is difficult to convert a user in a single social media post or a conversation. Constant engagement on the other hand is remarkably good at getting users onboarded into a new product or service. Think about how easily X onboarded users into Grok or how Alphabet did it with Gemini. Signing people into the social media arm means the community can convert these users into long term $LEO investors and traders. The best part is that we are not at the mercy of any centralized company or a hidden algorithm that can shadowban us.

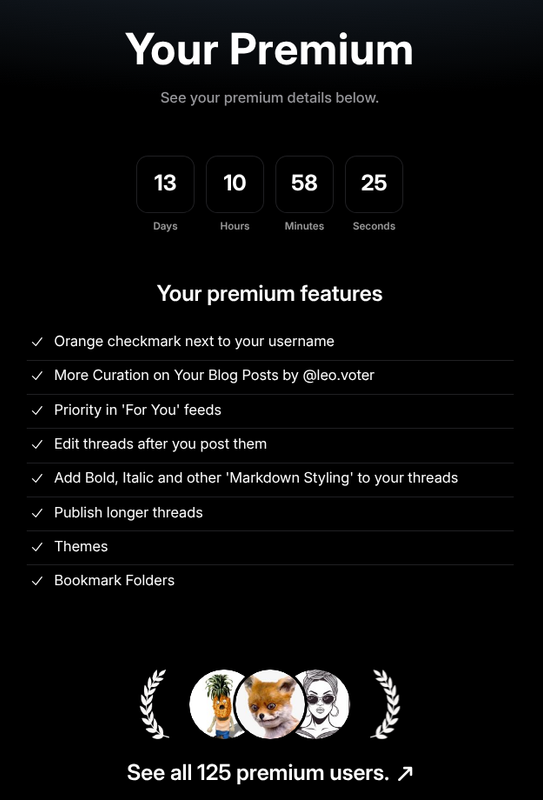

Premium Funds Author + Curator Rewards

It is common for power users to purchase a Premium subscription. The best way to get more Premium users is to simply have more active users. I don't think we are doing enough promoting INLEO to LeoDEX users. We have to feature INLEO more prominently and get some of the curious users to try out what we have built on HIVE. We need more investors with HIVE Power that are onboard with the vision of INLEO.

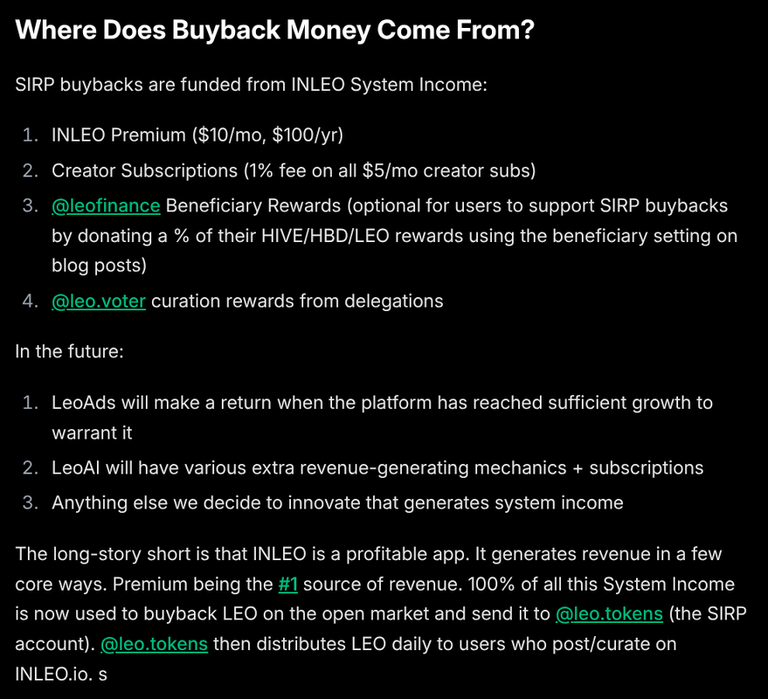

Summary on Buybacks

If you would like to learn in even greater detail, read this article from @leofinance blog. The above screenshot is taken from there. If you think this is a viable strategy, you can decide to invest in $LEO. If you read along, I have shared some very good tips that will provide you with better entry points.

Optimize Your LEO Purchase

The price has roughly doubled since what we saw few months ago. The improvements to the Tokenomics worked. There is no inflation and all the Rewards given out to users and investors come from a real revenue source. There were 2.5 million LEO reserved for the volume based Airdrop to LeoDEX users. There are some conditions for the Airdrop:

- Minimum $1,000 trading volume required.

- Must connect an Arbitrum wallet address to accept the reward claim (as LEO is an Arbitrum native token).

- Active trading during campaign period.

- Must create a referral code.

We are not sending Tokens at anyone that trade. Since the traders have to create a referral code, they might as well promote LeoDEX when they can. Whales are more likely to know other Whales.

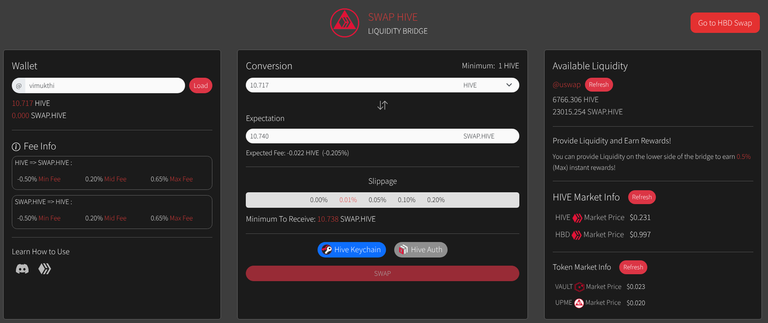

Always Check Out @uswap

Look at me earning 0.205% HIVE when I "bridge" my $HIVE to HIVE-Engine for trading. Whenever there is low liquidity on one side of @uswap, user can get instant rewards for providing liquidity. Even when there are no negative fees, @uswap is often the cheapest place to swap between HIVE and SWAP.HIVE.

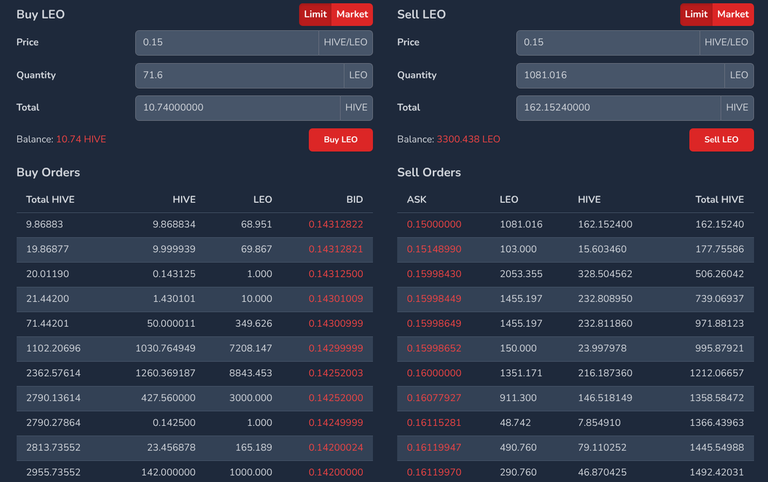

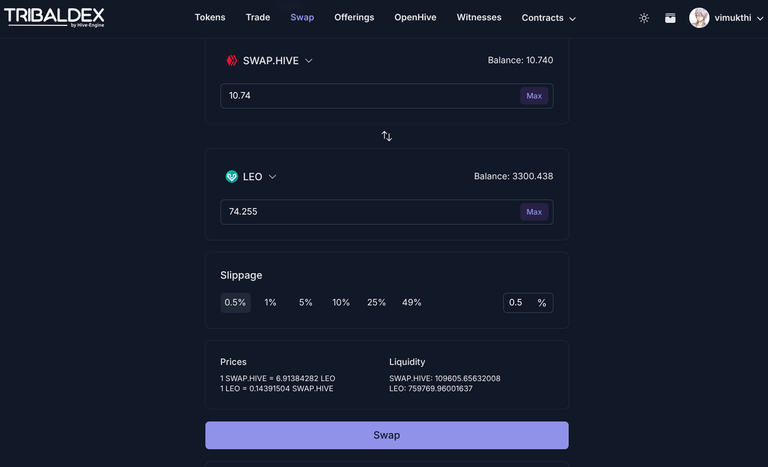

Compare Orderbook vs Dieselpool

It makes sense for the investors to not sell their LEO. It should not be a surprise that the orderbook look the way it does. The trick is not in making some buy order at a lower price and hoping for it to get filled. The best thing to do is check the other places where you could buy LEO.

There are other alternatives on EVM Chains (Arbitrum, BNB Chain and Polygon). Those trades have more fees involved and some bridging of assets in some cases. If you are reading this article, you are likely a HIVE user. If that is not the case, make an account now. With these tips and investment thesis, it is easy to to follow and evaluate where $LEO will be and bet accordingly. Follow the resources provided in this article and track the revenue as you wish. The revenue you see brings value to the Token by going 100% on buybacks.

Happy Investing!

Posted Using INLEO