The Greek market outperforms the American one! And it looks like... we're just getting started!

THE RALLY

The Greek stock market continues its unstoppable upward trajectory. After the shock of the pandemic, it has consistently delivered positive returns: 2020, 2021, 2022, 2023, and 2024. And now, we're on track for the sixth consecutive year of gains. This consistency builds investor confidence and is a sign of market maturity.

But this time, the rise is NOT based on bubbles and speculation. It's built on fundamentals. Greek companies are TRULY profitable. And do you know who proves this beyond doubt? Greek banks!

In fact, JP Morgan recently confirmed this, noting that Greek banks are showing exceptional profitability and capital strength, which is one of the key reasons why the Greek stock market is performing so well.

National Bank of Greece (NBG) posted net profits of €371 million in the first quarter, 20% above estimates!

Eurobank reported net profits of €349 million, with a return on equity (ROE) of 16.2%.

Alpha Bank posted profits of €223 million, with standout performance in fees and commissions.

All three banks have received an Overweight rating, meaning even higher valuations are expected in the future.

THE ECONOMY

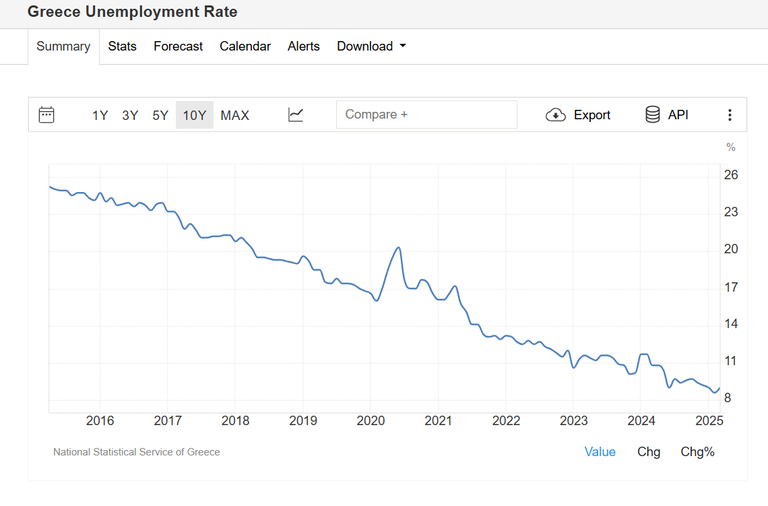

But it's not just the banks. The Greek economy as a whole is showing impressive figures:

A primary surplus of 4.8% and a fiscal surplus of 1.3%.

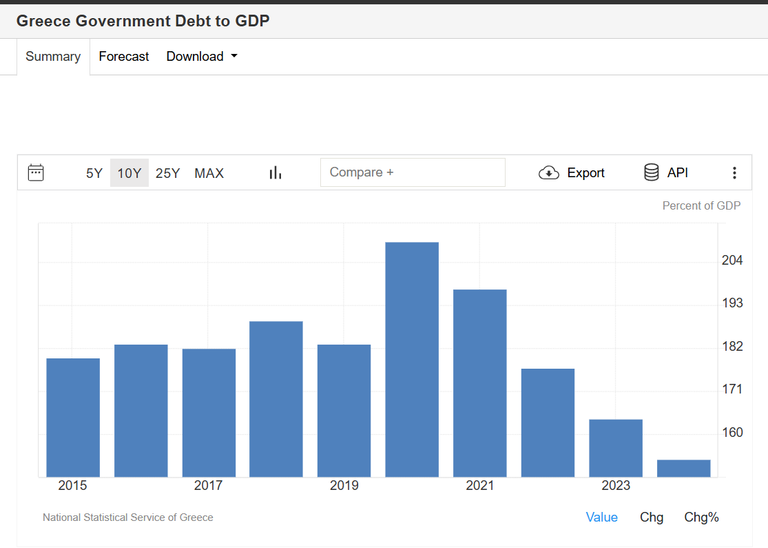

Debt reduction since 2020, aiming for less than 100% of GDP by 2030.

The cost of servicing the debt is just 1.73%, with an average repayment period of 19 years. Yes, Greek debt is now cheaper than German debt!

This means greater flexibility in the future, more resources for growth, and the stability that the Greek economy has long needed.

And here's the best part: The total market capitalization of the Greek stock exchange as a percentage of GDP is JUST 35.3%, while the European average stands at 82.7%. This is the largest investment gap in Europe.

This means one thing: the Greek stock market is EXTREMELY UNDERVALUED. And sooner or later, this gap will close. When that happens, today's investors will see massive capital gains.

Already, the total market value of the Greek stock market has reached €107 billion and continues to grow. Foreign investors are returning, and rating agencies are steadily upgrading us. Sentiment is changing, confidence is returning, and momentum is building.

Posted Using INLEO