On the one hand, we have GDP, which SUDDENLY dropped more than we expected, and on the other, the labor market keeps throwing its own party.

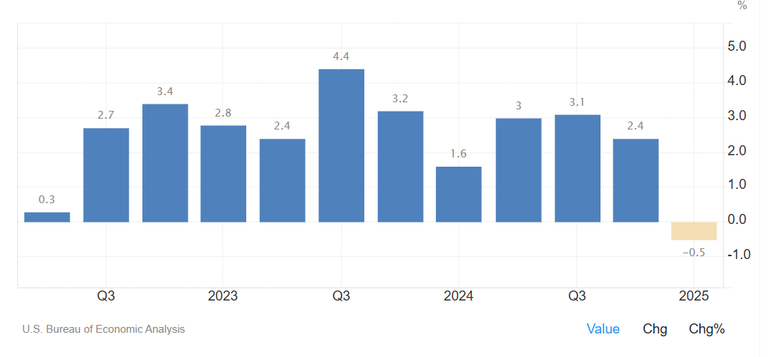

GDP

Let’s start with U.S. GDP for Q1 2025, which, as we saw yesterday, was revised down to -0.5% from the previous estimate of -0.2%. That’s a dramatic change, especially considering the economy had grown by 2.4% in Q4 2024!

And what caused that? Mainly lower consumer spending and reduced exports — though this was somewhat offset by a drop in imports as well.

Looking deeper, the real final sales to private domestic purchasers index rose by only 1.9%, compared to the previous estimate of 2.5%. This metric is crucial because it shows how much households and businesses are actually spending domestically. So yes, there’s a clear decline in demand.

At the same time, there was a small upward revision to inflation: the PCE index increased by 3.7% (up from 3.6%), and the Core PCE — which excludes food and energy — rose to 3.5% from 3.4%. Of course, we’re also expecting the new data for this today...

But those numbers maintain pressure on the Fed not to cut interest rates anytime soon.

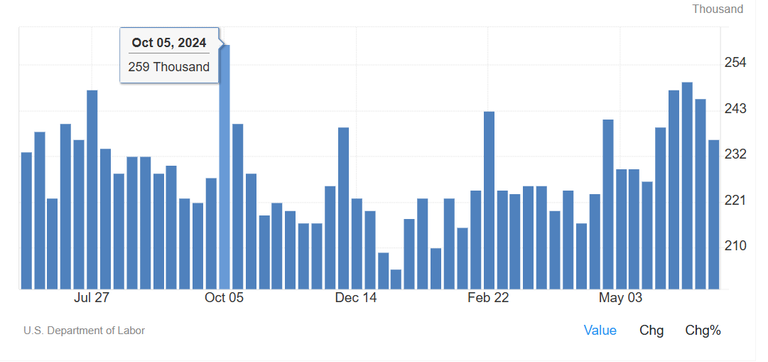

UNEMPLOYMENT CLAIMS

Now... IF YOU THOUGHT that with such negative GDP numbers, the labor market would start to struggle... think again.

Initial jobless claims for last week fell by 10,000, coming in at 236,000 — lower than the forecast of 244,000.

And the 4-week moving average? That dropped too, down to 245,000 claims.

In other words... the labor market not only shows no signs of collapse, but it’s holding up strongly.

This means businesses are still retaining their staff, which is totally inconsistent with the picture of an economy that’s supposedly slowing sharply. Something doesn’t add up. And that’s exactly what makes today’s news... MIXED.

The economy is slowing, but the job market remains steady. Like hitting the brakes and the gas pedal at the same time.

And now comes the most important announcement: the Core PCE — the Fed’s favorite inflation gauge — which we’re expecting later today.

If it comes in high... the chances of a rate cut this year will drop significantly.

But if we see a lower reading, then we might get the green light for a looser monetary policy this fall.

Can you imagine what Trump will start saying again if it turns out rate cuts should happen?

Posted Using INLEO