Let’s talk about Tesla’s latest financial results and how exactly they affected investors.

Spoiler alert: They're not exactly jumping for joy. And honestly, they might have a point.

EARNINGS

So, Tesla announced its results for Q1 2025. And folks… major letdown. The company missed both earnings and revenue expectations set by Wall Street analysts. And as if that wasn’t enough, they scrapped the guidance for the rest of the year. Basically said, “We’ll see what happens.” And let’s be real—that’s not exactly the most reassuring message to send to investors, right?

But let’s dive into the details and the numbers, because that’s where the real juice is.

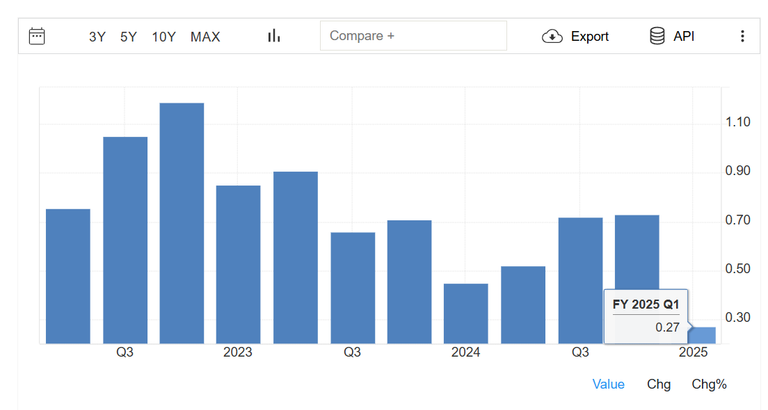

The company reported earnings of just $0.27 per share, while analysts had expected $0.42. That’s a 35% miss! And compared to the same quarter last year, when earnings were $0.45, that’s a 40% drop. Ouch!

Total revenue came in at $19.34 billion, down 9% from last year—and of course, below expectations.

But the biggest blow? Automotive revenue. That dropped to $13.97 billion, a 20% decline! That means the company’s core product is hitting rock bottom. And that’s definitely not a good sign.

Now, to be fair, let’s talk positives too. Tesla’s energy generation and storage segment did great—up 67%. And service revenue rose 15%. Solid numbers. But let’s be honest—no matter how good those segments are, they can’t carry the company alone. When your main gig is cars and car sales are plunging, everything else is just background noise.

And now let’s talk profit margins. More pressure here. Gross margin dropped to 16.3%—better than the worst-case scenario analysts feared (12.7%)—but still far from Tesla’s golden years. And the operating margin? Just 2.1%. We’re talking almost zero operating profit.

And now you’re probably wondering, So what went wrong, man?

Well, Tesla says the main issue was a bigger-than-expected drop in vehicle deliveries. They delivered 336,681 cars—13% down from last year. And production dropped 16%. On top of that, operating expenses increased. So, yeah—double trouble.

OUTLOOK

So, what does Tesla say about the future?

First, because of general market uncertainty and cost volatility, they’re not giving any clear forecasts for the rest of 2025. They just said they’ll revisit it in Q2. Which basically means… they don’t know either.

Second, they tried to calm everyone down by saying they’re still on track to start producing cheaper models in the first half of 2025. And the much-hyped Cybercab? They now say production will begin in 2026 or later.

STOCK

And let’s not forget—since the start of the year, Tesla’s stock is already down 37%! How much lower can it go?

Of course, part of that has to do with Elon Musk deciding to play politician over the last few months—which didn’t sit well with Tesla investors. They want him focused on steering the company, not giving speeches.

So, if you believe Elon will ditch politics and get back to business—and that Tesla can bounce back strong—then this dip might just be a solid opportunity.

Posted Using INLEO