Hello Everyone,

Have you ever stopped to think about how taxes affect us and what the government does with the tax revenue?

I don't know about you but to me, I think taxes are getting overwhelmingly hikes, so also the price of things and bills.

So I'm gonna start from where I'm super pained, I am doing a Business that requires funds into my account and funds going out of my account, apart from the charges from the various financial institutions, our government taxes too come in so much extreme measures, it's so crazy that we do a lot of Work hoping to get some profits, only for the government and banks end up taking the Lion shares.

This is not even the worst of all, the worst now is that so many private companies are now liaising with the government to get compulsory taxes from people, although I can allegedly say that the telecom companies in Nigeria are part of this Extortion and tax games.

Presently the cost of Data suddenly rose up to more than double of it price.

It's so painful and disheartened, that even to buy data in my dear country is now so costly and the worst part is that, the data just doesn't last.

The same with calls, you can load a #1000 (one thousand naira card) this morning and by evening you get a beep that your account Balance I low.

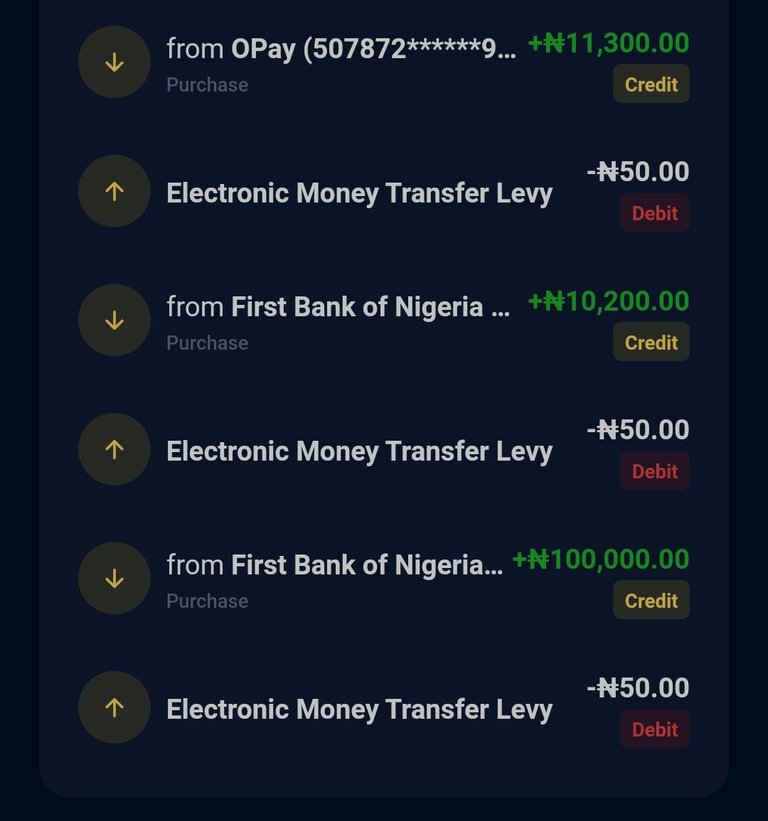

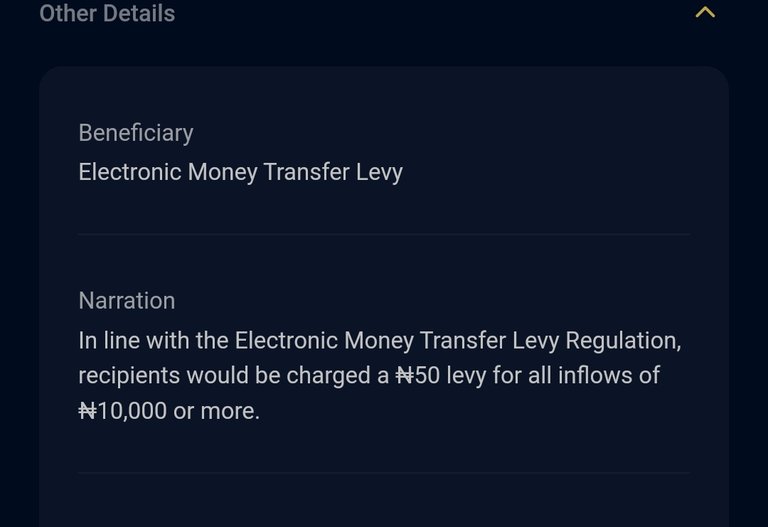

(Transfer levies on transaction on my bank app)

All this are not even all,FIRS (Federal Inland Revenue Services), the State Revenue service and even the Local government Revenue service, will always go to my office and outlets every day to collect the Levi.

It's so much overwhelming and frustrating at the same time.

On the Road, we have tax collectors that are ever ready on the highway and streets to collect tax on Vehicles, this in turn make the price of transport really skyrocket,

In Benue state we have a lot of Produce tax collectors for those transporting goods and services but our roads are still bad.

As a member of society, it's essential to understand the role taxes play in shaping our lives and communities. In this post, we'll take a closer look at the impact of taxes and explore ways the government can put tax revenue to good use.

How Taxes Affect Us

All this money they have been collecting for exactly?.

We should all know that Taxes can have a significant impact on our lives, both positively and negatively. Let's break it down:

Taxes can be a real financial strain, especially for those who are already struggling to make ends meet. High tax rates can leave individuals and families with less disposable income, making it tough to afford basic necessities like housing, food, and healthcare. I've seen friends and family members struggle with this firsthand.

Also Taxes can also influence economic growth by affecting consumer spending, investment, and job creation. High tax rates can discourage entrepreneurship and investment, while low tax rates can stimulate economic activity. It's like a delicate balance too much tax and it can stifle growth, but too little and we might not have enough revenue for essential public services.

(*Screenshot from my phone)

On the other hand, taxes fund essential public services like healthcare, education, infrastructure, and law enforcement. These services are crucial for maintaining a high standard of living and promoting economic growth. Think about it without taxes, we wouldn't have roads, schools, or hospitals.

But Is our Government putting these taxes to good use??

My Answer is a Big No, most of the time we have a lot of government projects being abandoned, some were poorly made , some infrastructure take years to finish, some hospitals and Health Care centres still lack important gadgets, and equipments, others like security, our soldiers and people in force keeps complaining of lack of Ammunition, others complained of delayed salary payments and poor payments.

In conclusion

For me the government can really help do what they are collecting our taxes for like Investing on Infrastructure Development such as roads, bridges, and public transportation, can improve the quality of life, stimulate economic growth, and create jobs.

Also Funding education and healthcare initiatives can improve the well-being of citizens, increase productivity, and reduce poverty. For instance, investing in early childhood education can have long-term benefits for individuals and society as a whole.

This is my Response to #hl-w160e3