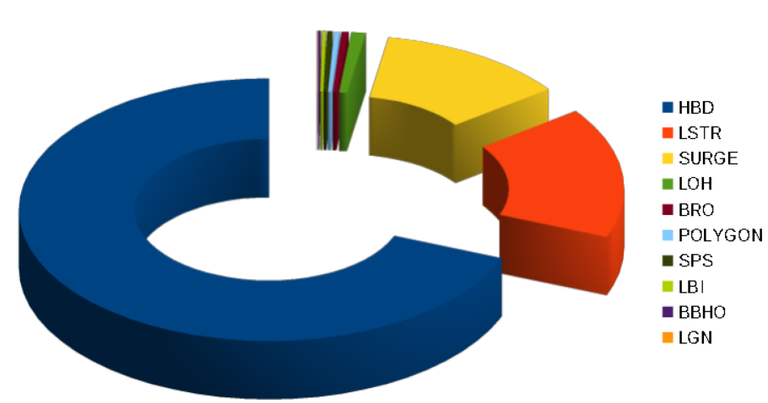

The latest on-chain data reveals an interesting distribution of trading activity across multiple tokens. At the top of the list is LSTR, with an impressive 524.59 in trading volume, far outpacing all others. SURGE follows at 400, indicating strong investor interest, while LOH rounds out the top three with 30.66. This sharp drop after the first two leaders suggests that liquidity is concentrated heavily at the top, with smaller but still active markets further down the chart.

In the middle of the pack, we see moderate but consistent trading volumes. BRO comes in at 15.11, while SWAP.HBD is close behind at 14.99. SWAP.MATIC and SPS post volumes of 12.30 and 11.69, respectively—figures that suggest steady transactional use or niche demand within their ecosystems. These mid-tier tokens may be less headline-grabbing but can still play crucial roles for traders seeking diversification.

Rounding out the list are tokens with smaller trading volumes but potential niche significance. LBI registers 8.25, BBHO shows 6.50, and LGN closes the ranking with 1.50. While these numbers are modest compared to the leaders, such tokens can sometimes benefit from lower liquidity environments, making them interesting candidates for strategic entry points if market conditions shift.