My plan was to skip posting today and postpone my analysis for tomorrow as I'm quite tired, but then I thought I'd make an effort and post it, maybe there are people who are interested, so here it is.

The monthly chart has not changed much, even though $HIVE has not been staying in one place, there was volatility last week, right now it's at almost the same level as last week, so you can read what I said in my last post as it's still valid. We still have 13 days till the candle close, so we'll see then.

The weekly chart looks good. Last week price managed to close above the bearish gap that has been capping the market (holding it hostage) for seven weeks. This week's candle is not closed yet, there are still 9 hours to go, but so far the bullish candle of this week is above the gap. This week price retested the gap and the weekly bullish order block (OB) and bounced off nicely.

In case of bullish continuation, I'm looking at $0.3006 as the next liquidity pool to be swept. In case of weakness, which is not present at the moment, the next swing low (which will be confirmed once this week's candle closes) is $0.2289. In case of more weakness, the levels are marked on the chart, respectively: $0.1775, $0.1639, $0.1568 and $0.1467.

On the daily chart, I can say price went into consolidation this week, or there's indecision in the market. The bearish gap, marked with yellow has been rebalanced already om the 25th of March, but price has never been able to close above it and invert it. At the time of writing, price is below the gap again, so chances are, today price is not going to close above the gap either.

In case of weakness, I'm looking at the swing low at $0.2502, to be swept. We have a bullish gap which is between $0.2393 and $0.2477, which has not been retested yest. In case price can not bounce after sweeping the swing low at $0.2502, retesting this gap can happen. If this gap can't defend price, the next level to be retested is $0.2289, or even $0.2166.

In case of strength, I'm looking at $0.2844 to be swept and in case of bullish continuation, in case price inverts this bullish gap (price closes above the gap), the next swing high to be swept is $0.3006 and $0.3201.

The h4 chart shows the consolidation I was talking about earlier. Price is undecided or consolidating here, which is not a bad thing. If I count my dealing range between $0.2844 and $0.2527, at the time of writing, price is slightly above mid range. There are no gaps on the sell side, which means no internal liquidity, so the next liquidity pool is at range high ($0.2844) and range low ($0.2527). If I would trade the 4h chart, this would not be a trading zone for me. We're going to see more clarity next week I think.

The funny thing is, I just noticed Tradingview's Latest Update on Hive, and it says HiveFest 10, From 15 October to 19 October this year 😀

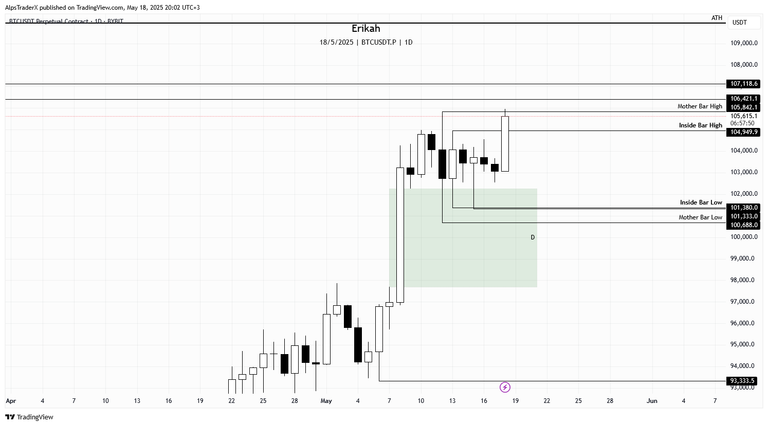

As far as $BTC is concerned, we have a nice inside bar pattern formed on the daily chart and at the time of writing, price retested the mother bar high (swept liquidity above the swing high at $105,842) and it is back in the range again, but above the inside bar. As you can see, today price made a nice move to the upside. In case the bullish tend continues, I'm looking at $106,421 and $107,118 to be swept.

In case price loses momentum, the next swing low to be revisited is at $102,539, but this level will be confirmed as swing low only after the current candle closes. In case there's more weakness in the market, $101,333 could be next, or $100,688.

The economic calendar is pretty light for next week. I don't think I've ever seen one red folder day per week till now, but we have it next week. However, unemployment claims is important, so it's going to move the market for sure.

Remember, technical analysis is not about forecasting price, but about reacting to what price does.

As always, this is a game of probabilities, not certainties. Also please note, this is not financial advice, it's my view and understanding of the market.

All charts posted here are screenshots from Tradinview.

Come trade with me on Bybit.

If you're a newbie, you may want to check out these guides:

- Communities Explained - Newbie Guide

- Cross Posting And Reposting Explained, Using PeakD

- Hive Is Not For Me

- How To Pump Your Reputation Fast - Newbie Guide

- Tips And Tricks & Useful Hive Tools For Newbies

- More Useful Tools On Hive - Newbie Guide

- Community List And Why It Is Important To Post In The Right Community

- Witnesses And Proposals Explained - Newbie Guide

- To Stake, Or Not To Stake - Newbie Guide

- Tags And Tagging - Newbie Guide

- Newbie Expectations And Reality

- About Dust Vote And Hive Reward Pool, by libertycrypto27