I've been dipping my toes in general finance for a long time. I was buying stocks long before I ever got into crypto, and was trading currencies in that high risk game. In addition, back before I moved to Japan I was pretty aggressively playing the credit card game, getting my score up, taking advantage of sign up bonuses, and so on. My score is still quite high, above 800, and I have plenty of available credit, but living in Japan I don't really benefit from that world as directly as I would if I were still in the States.

Anyway, after getting into crypto I pretty much abandoned stocks and forex to focus here. I moved entirely out of the forex and while I still hold most of the stocks I did back then, I hadn't actively traded or researched new companies in years.

Hadn't. Last year I had the feeling that this crypto cycle would be a little different than past ones and I decided I'd start reacquainting myself with the stock market. Since then I have found a number of great channels and blogs and accounts to follow.

I'm going to recommend some youtube channels here. I won't embed any videos. Hive.blog is still suffering from a bug that won't show the post if you use the iframe tag, which is required for embeding youtube videos. So I'll just put in direct links.

First up: Rob Berger.

This is a pretty smart guy who gives practical advice on managing investments. He is older so does lean towards talking about retirement accounts more than others, but good investing advice is good investing advice. He definitely has more of that Warren Buffett Buy good companies and don't look at the price because you are holding long term approach and stresses fundementals and practical knowledge over charts.

I discovered him a few months ago and have been pretty religiously watching his videos since. He also presents his videos well and has obviously spent some time working up a script for each one, as there is almost no rambling or digression.

Start with his most recent video: How to Invest During Economic Chaos: Tariffs, DOGE & Deficit Concerns

@meno clued me into this guy. He is an economist who went into the high paying part of that business and did so well there that he was able to retire before 30. Now he does YouTube videos explaining economics and why everything is going so badly everywhere right now.

Don't let that last sentence scare you. He's not a radical—on either political side—but he's also not ignoring reality and pretending things are just peachy and is instead trying to explain some of the financial and economic reasons why things are as they are.

This one may not be as much practical advice like Rob Berger linked above, but at the same time it is stuff that it might benefit us to know about this crazy money world. Start with this video that @meno linked to: Why Your Economists Suck, but I also think his most recent video was fire. See: Why aren't we all getting rich from compound interest?.

This guy is a financial planner and writes for the Motley Fool. He knows his stuff. His videos often are very short and to the point, highlighting stocks that he thinks are underpriced.

What I like about him is he doesn't appeal to emotion, nor does he pull out charts, instead he looks at company data from their own financial reports and shows us why he thinks their stock is a good buy.

He occasionally does other videos too, for example a few days ago he did a recap of the Berkshire Hathaway Q4 Earnings.

He is a little dry, but like I said the videos are short, to the point, and I think packed with great info. Give him a try.

Start with this one: 3 Dirt-Cheap Warren Buffett Stocks to Buy With $1,000 Right Now.

Unlike Rob Berger and Matt Frankel, this guy is all about charts. At least the main guy, Nicholas Merten, is. He's recently gotten some helpers who make their own videos on his channel and I'm not as big of a fan of them, but the main videos by Nick are always good. He really dives into all aspects of not just the crypto market, but the stock market, and occasionally other markets as well.

Don't be fooled by his clickbait thumbnails, he isn't nearly as pessimistic as they show (which is inevitably something like "BTC is going to crash tomorrow") but is much more balanced, trying to show both the good and the bad. I know that rubs some people the wrong way and comes off more as avoiding taking a position, but I like it. He is a little long winded and tends to repeat himself, showing that he might not script his videos before shooting them, but he does offer good takes on things.

Start with his latest video: Bitcoin Is Collapsing | Here's What You Need To Know. Again, a bit of an extreme title. Normally I dislike YouTubers who go for the clickbait titles, but his advice is good enough that I'm willing to overlook it for him. I have made money using his info.

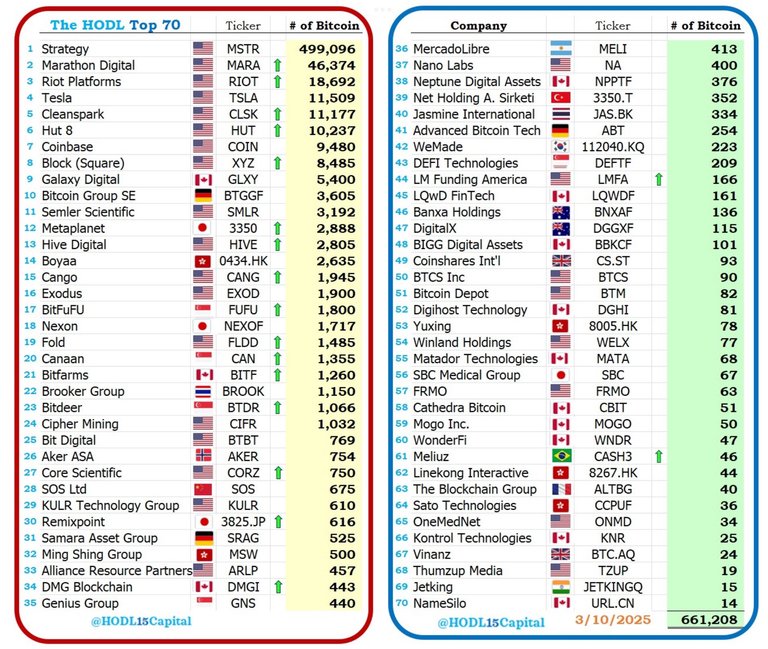

Not YouTube, but Twitter: HODL15Capital

This guy may be the only reason I still load up Twitter every now and then. His tweets track BTC inflow and outflow from corporation and large buyers. Not only that, but he publishes excellent charts like this one:

Showing the top 70 corporate holders of BTC, and this one:

Showing the top individual owners. Many other charts as well. It's a great account to follow!

And...we'll stop there. I have more, but I don't want to overwhelm. I recommend exploring those four channels and following that Twitter account. Stay with them for awhile and see what you think.

❦

|

David is an American teacher and translator lost in Japan, trying to capture the beauty of this country one photo at a time and searching for the perfect haiku. He blogs here and at laspina.org. Write him on Mastodon. |